Is Saudi Arabia The Answer to Easing Market Pressure?

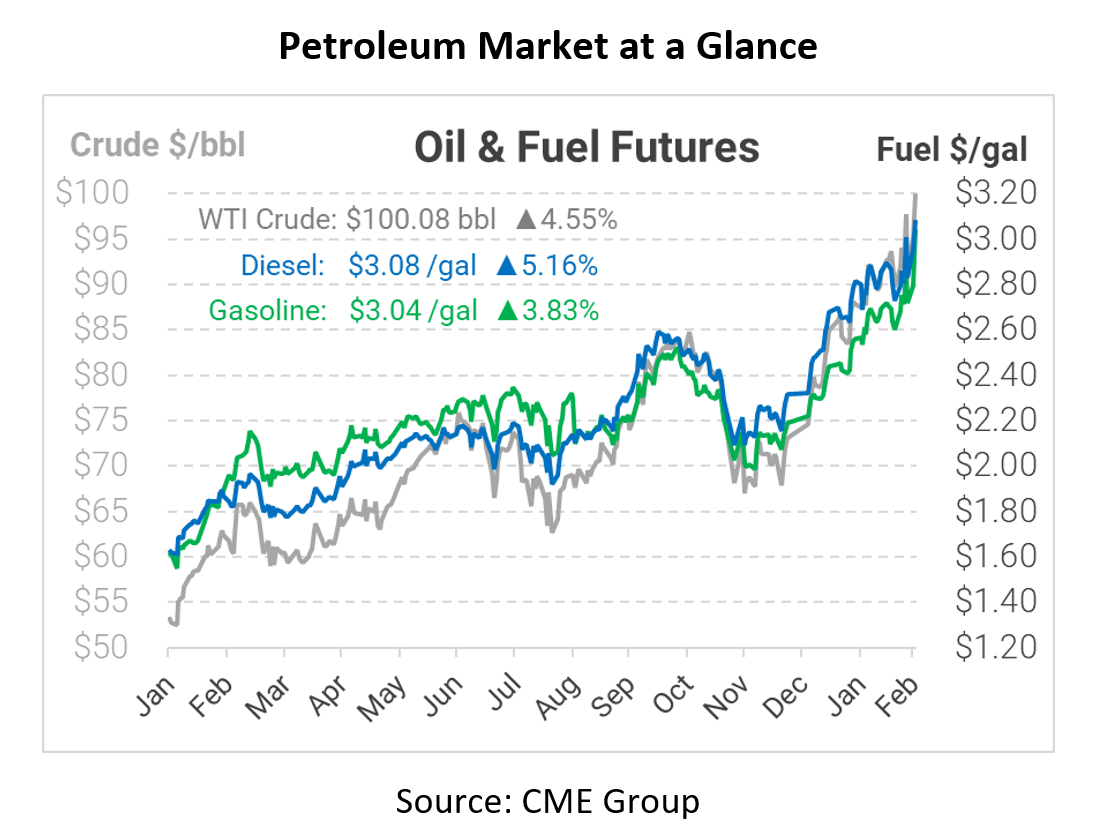

This morning WTI crude has risen over $4/bbl leading to a $100/bbl morning. Amid the rising tensions between Russia and Ukraine and the already weak supply and demand chain, countries are trying to find answers to relieve the pressure. Many now turn their focus toward Saudi Arabia and their influence on relieving rising market pressure.

As reported yesterday, many world powers are still searching for answers to relieving rising fuel prices amid the Russia-Ukraine conflict. Already, western oil companies such as Shell and BP are cutting their ties with Russian oil, leaving many to wonder how Russia’s oil industry will fair without western investment. Some countries have thought of Saudi Arabia as an immediate solution to the supply chain’s problems, but just how significant of a player could they be? Currently, Saudi Arabia can raise their production levels by 2 million barrels per day – but their willingness to add that much seems to be in question.

When confronted about possibly increasing output, the Saudi government insisted that OPEC+ continue to stick to their planned output schedule. Analysts suggest that Saudi Arabia is doing everything they can not to involve themselves in potential geopolitical tensions, so no move by Saudi Arabia will be expected. Since Russia is the other major leader in the OPEC+ alliance, Saudi Arabia fears upsetting Russia might dissolve OPEC+ unity. With nearly 12% of world oil coming from Saudi Arabia, their influence is evident; however, Saudi Arabia must walk a delicate diplomatic tightrope in appeasing both western allies and Russia.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.