Natural Gas News – October 26, 2021

Natural Gas News – October 26, 2021

Nat-Gas Surges On Forecasts For Below-Normal U.S. Temps

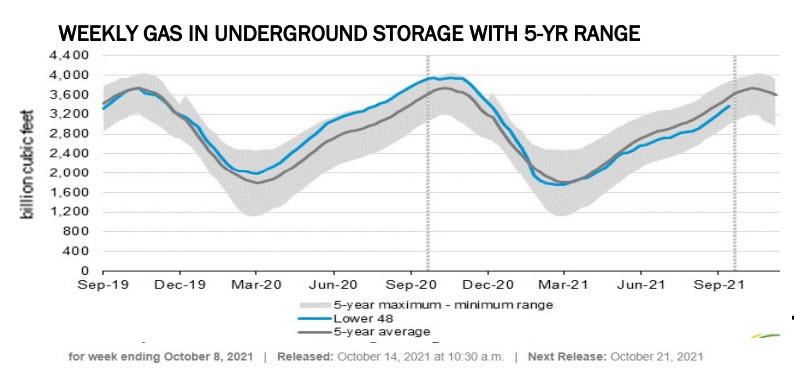

November Nymex natural gas (NGX21) on Monday closed up +0.618 (+11.70%). Nov nat-gas prices on Monday rallied sharply to a 1-week high. Forecasts for below-normal U.S. temperatures the first week of November sparked fund-buying of nat-gas futures on Monday. Also, surging U.S. nat-gas exports are bullish for prices as BNEF data shows gas flows to U.S LNG export terminals at 11.3 bcf on Monday, up by more than +10% since Friday and the highest in 5 months. U.S. nat-gas prices also have support from near-record high European gas prices as European nat-gas supplies are at the lowest level in more than ten years. An increase in U.S. electricity output is bullish for nat-gas demand from utility providers. The Edison Electric Institute reported last Wednesday that total U.S. electricity output in the week ended Oct 16… For more info go to https://bit.ly/3jB8SeY

U.S. natgas up 4% on forecasts cooler weather will boost heating

Oct 22 (Reuters) – U.S. natural gas futures climbed about 4% to a one-week high on Friday on forecasts for demand to rise as the weather turns seasonally cooler and a slight increase in global gas prices that should keep demand for U.S. liquefied natural gas (LNG) strong. Even though the forecasts called temperatures to decline with the approach of winter, those forecasts also predicted the weather would remain milder than normal through at least early November, keeping heating demand lower than usual for this time of year. Front-month gas futures NGc1 rose 20.6 cents, or 4.0%, to $5.321 per million British thermal units (mmBtu) at 8:07 a.m. EDT (1207 GMT), putting the contract on track for its highest close since Oct. 15. For the week, however, the front-month was still off about 2%, which would put it down for a… For more info go to https://bit.ly/3mfFYmE

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.