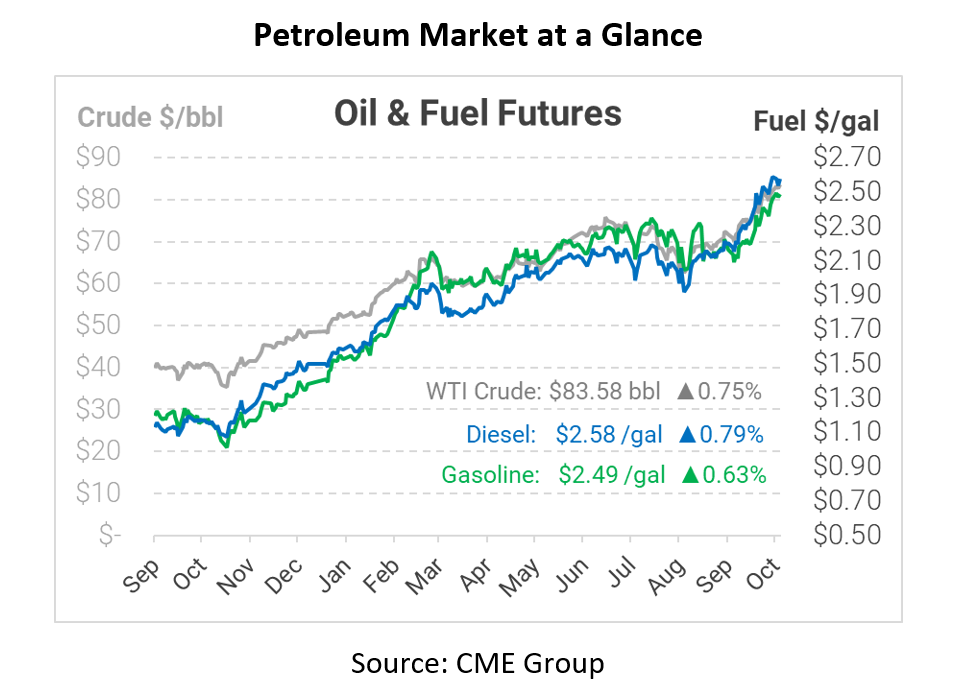

Inventory Draw Sends Fuel to Fresh Highs

Fuel markets have once again turned higher thanks to a bullish inventory report from the EIA this morning. Gasoline and diesel prices are once again moving towards multi-year highs, while crude oil has set yet another 7-year high. Along with climbing inflation and economic strength, fuel fundamentals point to an extremely tight supply picture, as we’ll explore below.

Although many headlines have pointed out market tensions, oil traders were expecting a relatively calm week. The consensus among traders was that crude inventories were moving higher, not lower; the API confirmed as much last night. This morning, however, the EIA showed across-the-board draws for all fuel products. Gasoline inventories fell more than twice as much as traders had expected. The message is clear – market fundamentals support the view that markets are tight and prices should continue rising.

Before the EIA’s report, oil prices were on their way lower thanks to supportive news from China. The country is now considering plans to subsidize rising coal prices, which would reduce the need to use crude oil for power. Crude prices sank by $1/bbl before rocketing higher later in the day.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.