Natural Gas News – August 3, 2021

Natural Gas News – August 3, 2021

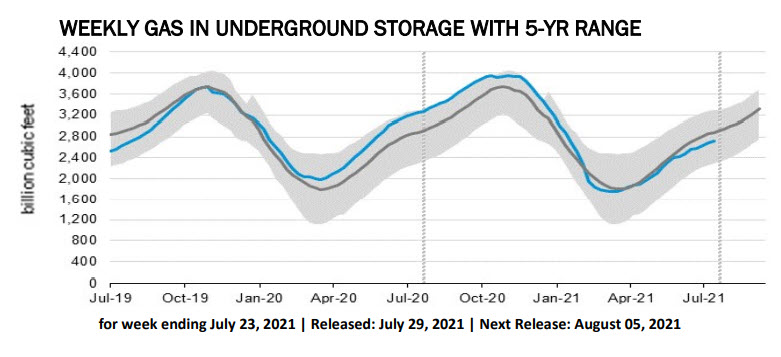

U.S. natgas rises on warm weather forecasts

Aug 3 (Reuters) – U.S. natural gas futures gained on Tuesday as forecasts continued to signal hotter weather over the coming weeks than previously expected, which tends to increase gas demand for cooling. Front-month gas futures gained 7.7 cents, or about 2%, to $4.012 per million British thermal units by 9:51 a.m. EDT (1351 GMT). “We’ve got some hot weather in most of the gas-consuming regions of the U.S., and the market will stay strong as long as the weather remains hot,” said Thomas Saal, senior vice president of energy at StoneX. “With higher gas prices outside the U.S. LNG exports should remain elevated, while supply ramps up at a slower pace than before, keeping the market tight.” Data provider Refinitiv projected U.S. demand, including exports, will rise from an average of 90.8 billion cubic fee… For more info go to https://reut.rs/3xwL4NP

Japan’s Decision To Cut LNG Demand Clouds Gas Outlook

Japan recently announced a new energy target for 2030, a move that sent shockwaves through the global market for liquefied natural gas (LNG). The plan to cut LNG consumption nearly in half could spoil the plans of LNG exporters worldwide, from Qatar to the United States. The new draft 2030 plan aims to dramatically scale back on the use of fossil fuels in an effort to hit climate change targets. The plan calls for the use of LNG in power generation to fall to 20 percent of the overall mix by 2030, down from 37 percent in 2019. That is also a more substantial cut than the 27 percent share by 2030 that the government had previously laid out. At the same time, coal use falls from 32 percent in 2019 to 19 percent in 2030, while renewables scale up from 18 to 36- 38 percent and nuclear rises from 6 percent to 20-22 perc… For more info go to https://bit.ly/3AbQjnP

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.