OPEC+ To Discuss Raising Supply

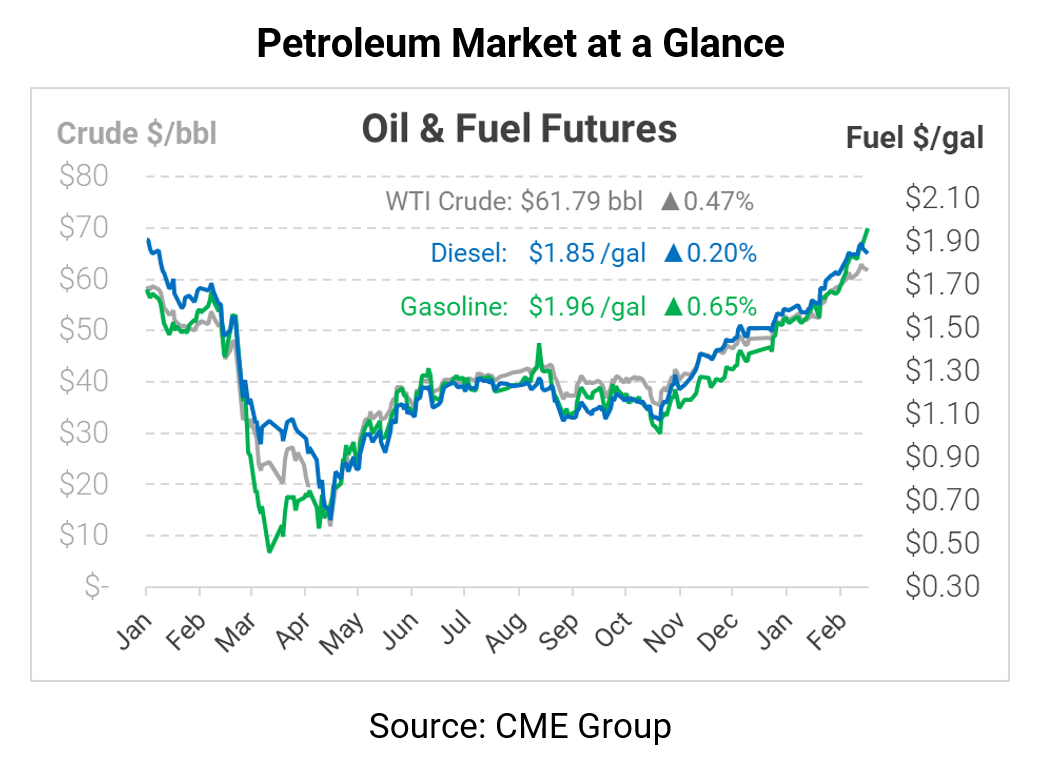

After shedding $2/bbl on Friday, oil prices are stabilizing. WTI crude remains above the $60/bbl threshold, in line with pre-pandemic pricing. Analysts have whip-sawed from bemoaning the global supply glut to broadcasting under-supplied conditions. Traders continue chattering about the possibility of $100/bbl oil amid a purported commodity supercycle.

At the heart of the bullish sentiment is the OPEC+ group, which continues cutting nearly 7 million barrels per day (MMbpd). The group is meeting on Thursday to decide whether to loosen quotas by 0.5 MMbpd, and Saudi Arabia may also reduce their voluntary 1 MMbpd cuts undertaken in February and March. Markets are clamoring for OPEC to raise its output and avert a rapid spike in prices. OPEC must also weigh the possible return of Iranian oil supplies, and that of competitors like US shale producers. Shale companies seem to be focused on generating cashflow and maximizing existing wells instead of drilling new, but prolonged high prices might coax them to start drilling again.

Gasoline prices posted a large increase in futures markets as the trading contract rolled from March to April, reflecting low-emission summer fuel spec. Summer gasoline is both more costly to produce and more in-demand by consumers, so it’s normal to see prices pop ~10 cents in the spring. The important question is whether warm weather will be enough to get consumers driving again. Demand remains 1 MMbpd below normal levels, so consumers have both a figurative and a literal long road ahead to filling in lost demand.

This morning, crude prices are moving slightly higher, though dollars off from the highs set last week. WTI crude is currently trading at $61.79, up 29 cents from Friday’s closing price.

Fuel prices are seeing moderate gains, in line with crude oil. Diesel is trading at $1.8467, gaining 0.4 cents from last week. Gasoline, supported by the conversion to summer-spec fuel, is trading at $1.9631, up 1.3 cents (or up 7 cents if you compare the expiring March contract to the new April contract).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.