Is the Next Bull Supercycle Here?

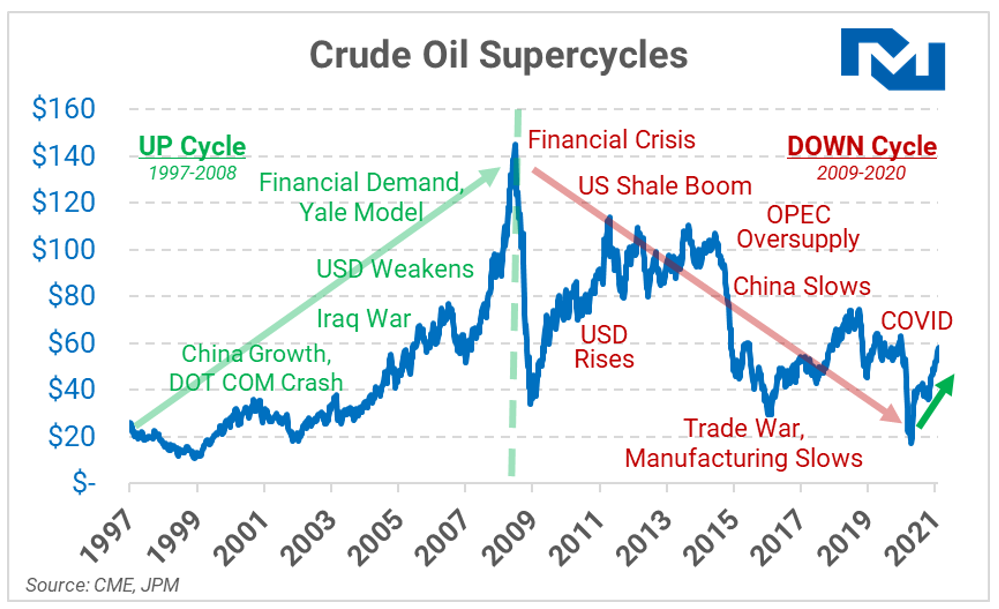

Understanding and predicting oil prices can be a challenging, but some forecasters believe that oil markets move in overarching waves that drive market prices higher or lower. Using this theory, some believe that oil prices are heading back towards higher ground again.

A JP Morgan quantitative analyst, Marko Kolanovic, is forecasting a commodity “supercycle,” driven by the post-pandemic recovery, low interest rates, and a weak US dollar. The last supercycle began in 1996, climbing to a high in 2008 before returning to $20/bbl during the 2020 COVID pandemic. The article notes four supercycles occurring over the past 100 years, with the latest rally driven predominantly by China’s rise, a weak US Dollar, and portfolios diversifying beyond equities into commodities under the Yale model of diversification.

JP Morgan continues, listing a plethora of factors that could spur the upswing in the next supercycle. Although some fear a double-dip recession in 2021, others believe the global economy is poised for strong growth in the future. Among the factors supporting oil over the next decade:

- Post-pandemic recovery (a new “Roaring 20’s”)

- The end of Trump’s US-China Trade War

- Loose monetary policy/interest rates globally

- Weakening US Dollar

- Inflation due to spending

- Government stimulus spending

- Slow starts for alt fuels and EVs

- Reduced

What does this mean for fuel consumers? While the commodity supercycle theory certainly has its critics, it suggests that prices could trend higher overall over the coming decade. Cycles move in fits and starts, making it hard to predict the events of any given year. Still, the theory suggests that the major trend in prices will be upward, so consumers should be cautious in their budgeting and planning cycles for future years.

This article is part of Daily Market News & Insights

Tagged: bull, crude forecast, Supercycle

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.