Refiners Struggle on Weak Gasoline Prices

Oil prices are coming off nine-month highs set on Friday, with focus transitioning to the renewed lockdowns in parts of the US. California implemented a stay at home order this weekend, which will certainly impact gasoline demand in the country’s largest consuming state. Last week, the COVID pandemic became the leading weekly cause of death in the US, surpassing heart disease.

Not long ago, we highlighted the rising strength of diesel spreads (the price of diesel vs. crude), demonstrating growing confidence in the US economy in the future. On the other hand, gasoline crack spreads have continued sinking lower since we shared that analysis and are now barely above 15 cpg. The pandemic has suppressed consumer behavior and will likely remain tough this winter before improving next year.

For refinery margins, represented by the 3:2:1 crack spread, the net effect of rising diesel prices and falling gasoline prices has been net neutral, keeping crack spreads in the $8-$10 range. Compared to historically “average” $12-$25 spreads, this low crack spread clarifies why refinery utilization has struggled to regain pre-hurricane season levels. Refiners do not see enough demand to justify increasing their throughput, so they face the double whammy of low margins and low volume. It should come as no surprise that poor spreads and low volume spurred a litany of refinery shutdowns worldwide this year. Forward-looking analysis from Kearney shows that one in three refiners will need to reevaluate its operating structure and make changes.

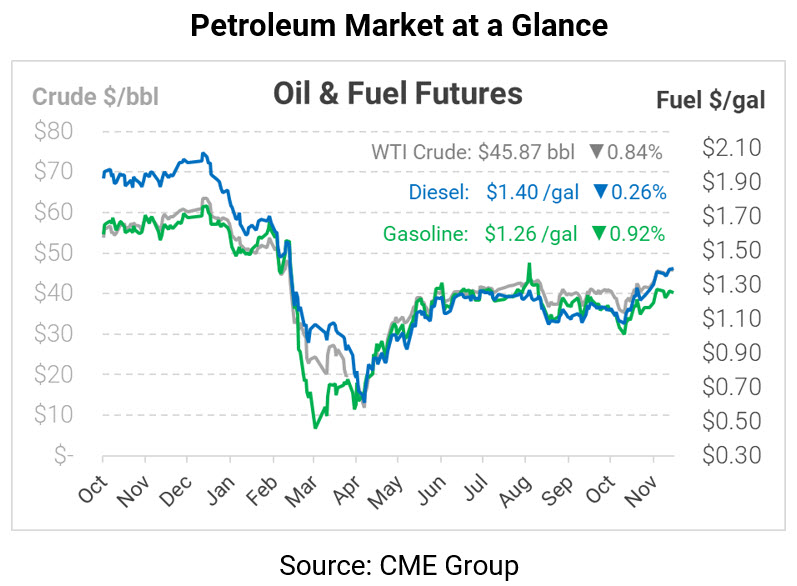

After propelling prices to nine-month highs, traders are giving up some of their gains this week. The relatively small losses, though, suggest this move is just a slowdown in the rally rather than a panicked response to lockdowns across the US. WTI crude is trading at $45.87, down a mere 39 cents from Friday’s high.

Fuel prices are also experiencing a small retreat. Gasoline prices are trading at $1.2568, down 1.2 cents from Friday’s closing price. Diesel remains at nearly a 15 cent premium to gasoline, trading at $1.3993, a 0.4 cent loss.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.