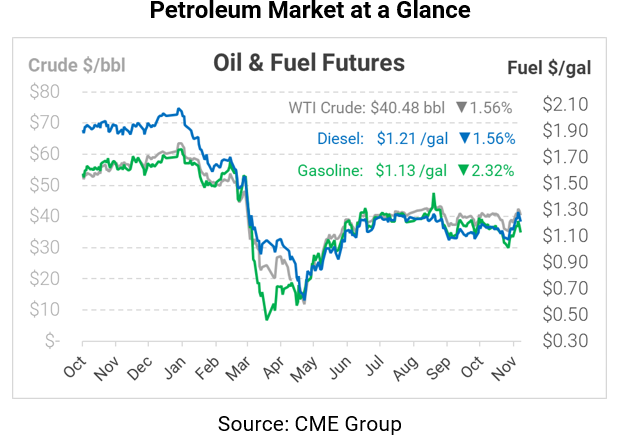

Diesel Strength Suggests Higher 2021 Fuel Prices

Oil prices are dropping this morning following a bearish EIA report yesterday – at least, bearish for crude. The EIA reported a large surprise inventory build for crude, which sent the market tumbling. With COVID cases rising around the world, traders interpreted the drop as a bearish foreshadowing of the rest of winter. Still, fuel inventories showed more stability, with gasoline and diesel posting sizable draws.

In particular, the diesel draw continues a long path towards normalization for a product that for months struggled to whittle down excess inventories. The 5.4 MMbbl draw puts diesel on the cusp of the five-year range, down to just 15% above the five-year average.

Those draws have also had a notable impact on fuel prices. Diesel has quietly crept higher, putting significant distance between itself and gasoline prices. Today, the two products have nearly an eight-cent spread between them. Gains have been largely hidden within 3:2:1 crack spreads, which have been roughly flat in the $8-10/bbl range for months. But breaking out the diesel and gasoline components, diesel crack spreads (the price difference between a gallon of diesel and a gallon of crude oil) have risen 10 cents over the past two months, while gasoline spreads have fallen by nearly 10 cents. Although both products have shown steady inventory draws for the past few weeks, markets are growing more bullish on diesel fuel prices.

Both diesel and gasoline crack spreads remain suppressed, leaving plenty of room for products to rise higher. Over the past five years, diesel crack spreads have averaged 47 cents per gallon, and gasoline crack spreads have been 38 cents. Low refinery utilization has kept a lid on fuel prices, but several refineries have shut their doors entirely or switched to other products, which will keep supplies off the market and propel prices higher as demand returns. Keep an eye on refinery utilization – if refiners can get utilization above 85% while keeping inventories low, it would suggest that demand is finally able to absorb normal output, allowing more room for prices to rise.

As markets normalize and spreads return to normal levels, prices could rise by 20 cents or more. Most importantly, those gains could come even if crude oil prices don’t move at all. Although increasing lockdowns could once again disrupt demand this winter, eventually fuel buyers can expect fuel prices to rise to $1.45 or more in 2021, even if crude oil remains range-bound, as crack spreads return to historically average levels.

Despite the long-term upward outlook for fuel prices, today the market is fixated on short-term trends. Given the large EIA crude build, prices are falling across the board. Crude oil is currently trading at $40.48, down 64 cents (-1.6%).

Fuel prices are also sinking, with gasoline prices leading the way. Gasoline is trading at $1.1303, down 2.7 cents (-2.3%). Diesel prices are more in line with crude, trading at $1.2141 with 1.9 cent (-1.6%) losses.

This article is part of Daily Market News & Insights

Tagged: crude, diesel, Fuel crack Prices, gasoline

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.