Saudi Arabia Calls on OPEC+ to be Flexible

On Tuesday, WTI crude closed slightly higher even in the face of bearish inventory news. The API reported a larger-than-expected build in crude stocks but traders seemed to pin hopes on OPEC+ supply cuts and even rosier vaccine news. Pfizer announced yesterday that their vaccine was even more effective in late stage trials than originally reported. They announced efficacy rates of 95% – on par with Moderna’s vaccine. The vaccine news helped to rally crude yesterday and gains are continuing in early trading today.

Crude is seeing modest gains even as bearish inventory news ruffles the market. Traders seem to have tied their hopes to OPEC+ balancing the market. OPEC+ had a preliminary meeting yesterday where no formal declarations were made, but hopeful chatter was heard around the continuatuion and perhaps even deepening of supply cuts to be discussed at their official ministerial meeting at the end of this month. Saudi Arabia called on members of OPEC+ to be flexible to meet the needs of the market and to be ready to adjust supply cuts accordingly.

The API’s data last night:

The API reported a large build for crude of 4.2 MMbbls versus an expected build of 1.7 MMbbls. At Cushing, they had a build of 1.6 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had an increase. The EIA will report numbers later this morning.

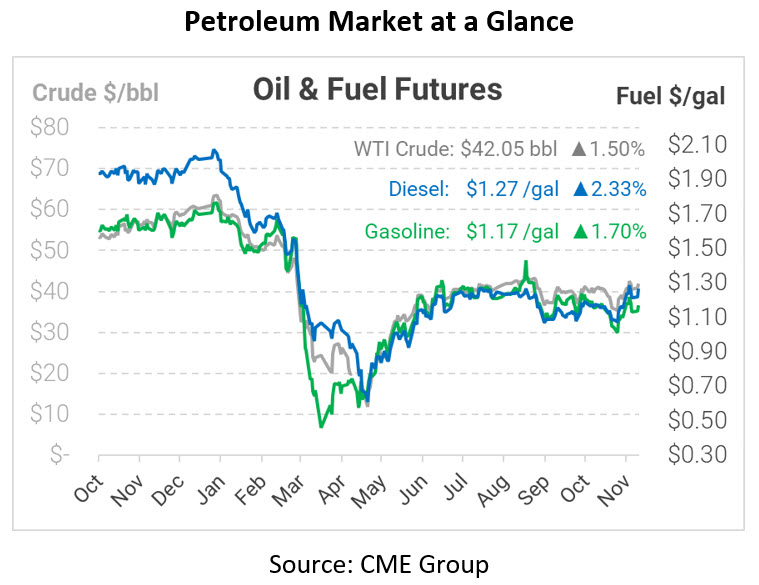

Crude prices are up this morning. WTI Crude is trading at $42.05, a gain of 62 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.2680, a gain of 2.9 cents. Gasoline is trading at $1.1728, an increase of 2.0 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.