Market Waiting on Clues from OPEC+

Crude closed up sharply yesterday on news of a second coronavirus vaccine with 95% efficacy. The vaccine, made by Moderna, is also more stable and can be stored at regular freezer temperatures unlike Pfizer’s vaccine which requires special low temperature storage. The market is giving back some of those gains this morning ahead of news from an OPEC+ ministerial meeting today.

The OPEC+ meeting today is a preliminary meeting which may hint at direction for the group before the official November 30 OPEC meeting. Traders are hoping for leaks and hints from today’s meeting as to how OPEC will act at the end of this month. Sources suggest that OPEC+ will not ease cuts by 2 MMbpd in January as they had planned. Faltering crude demand around the world due to the coronavirus and rising supply from Libya must be considered in any actions OPEC+ takes. Experts expect the likely course of action will be for OPEC+ to continue the current 7.7 MMbpd supply cuts into next year. The group is voluntarily giving up 4% of their volume and revenue by not decreasing output cuts to 5.7 MMbpd. Saudi Arabia will likely request further compensation cuts from those members who had been overproducing previously – namely Iraq.

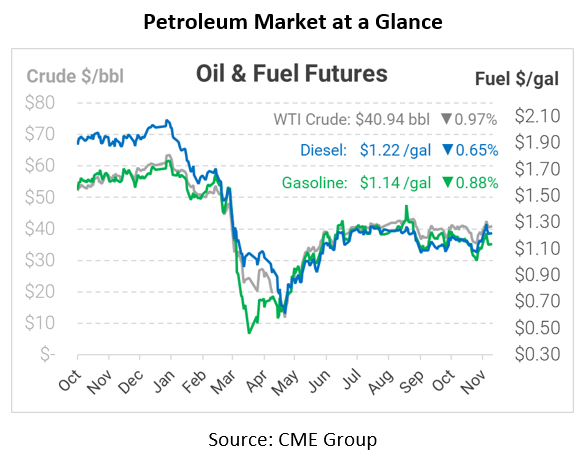

In early trading today, crude prices are down. Crude is currently trading at $40.94, a loss of 40 cents.

Fuel prices are down this morning. Diesel is trading at $1.2209, a loss of 0.8 cents. Gasoline is trading at $1.1367, a loss of 1.0 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, crude, diesel, gasoline, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.