Crude Market Waiting on Election Results

On Wednesday, WTI crude and US equities closed higher as markets embraced a likely divided government instead of the predicted “blue wave” that was expected. With a government that will have branches blue and red there is less of a chance of increased corporate taxes or government restrictions on business that could have been the case with an all democrat run government. Crude is trading sideways this morning as the world waits on the outcome of the US election.

Vote counting continues in several contested states with Biden having a lead in electoral votes. A Trump victory is generally considered as more bullish for oil as he has previously supported fracking and continued or stronger sanctions against Iran. A Biden victory would be considered more bearish to neutral as he has indicated his support for greener policies and a softer position on Iran. The most bearish situation for oil and markets in general would be a contested election with prolonged uncertainty. Experts expect to have more information as the day goes on.

The EIA reported a decrease for crude of 8.0 MMbbls, compared to an expected increase of 0.9 MMbbls. At Cushing, the EIA reported that stocks increased by 0.9 MMbbls. US crude oil inventories are about 7% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 18% above the five-year average. Gasoline inventories had a build and are about 4% above the five-year average.

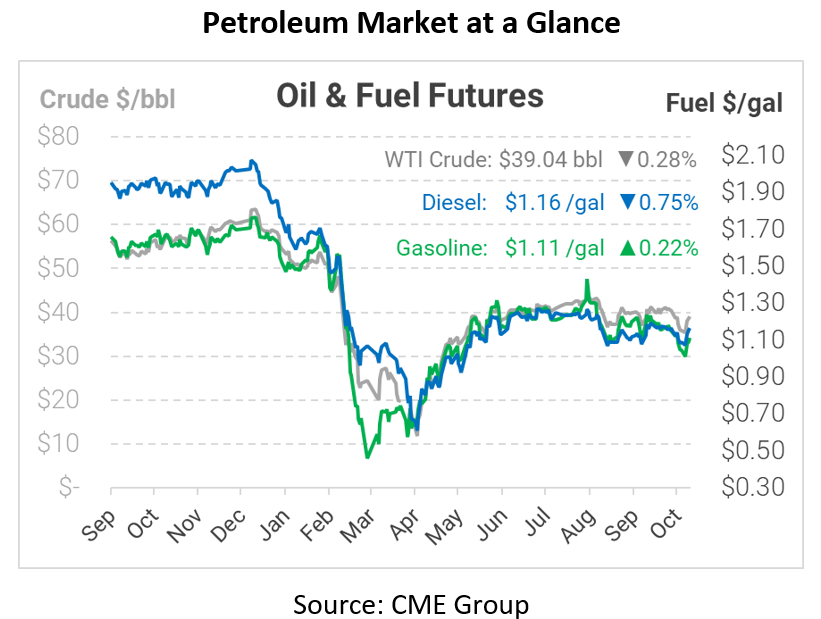

Crude prices are down this morning. WTI Crude is trading at $39.04, a loss of 11 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.1647, a loss of 0.9 cents. Gasoline is trading at $1.1105, an increase of 0.2 cents.

This article is part of Daily Market News & Insights

Tagged: crude, democrat, diesel, gasoline, US election

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.