Bullish Inventory News with Election Overshadowing Market

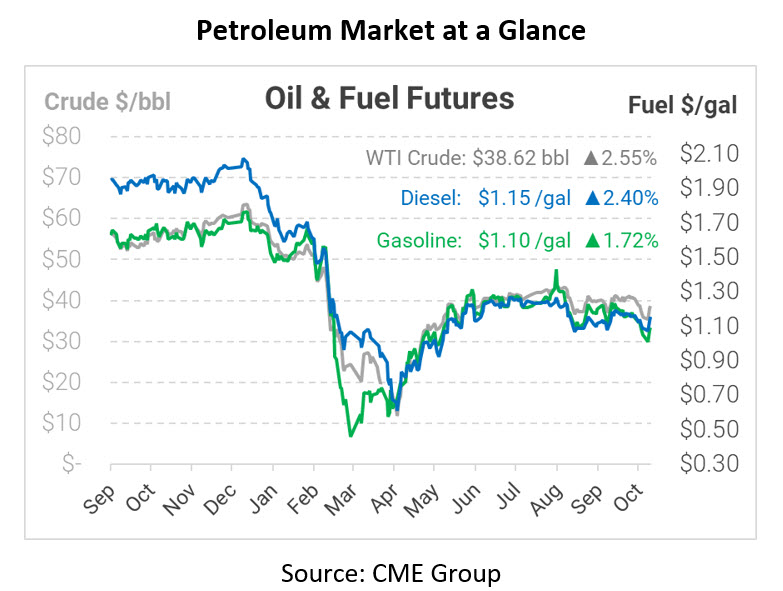

On Tuesday, WTI crude closed higher on positive demand news out of China and positive supply chatter from OPEC+. In early traing this morning markets continue to rise even in the face of uncertain US Election results. Votes continue to be counted in a tight US election in which Biden has a small electoral vote lead.

Yesterday afternoon the API reported a large draw in crude stocks that surprised traders and is lifting the market this morning. The rise in price is being capped by the shadow of the US election and the uncertainty around when a winner will be announced. Oil prices fell over 10% last week, with rising coronavirus cases and renewed restrictions in the US and Europe putting downward pressure on the market. The market is recouping some of those losses this week – clinging to each piece of bullish news.

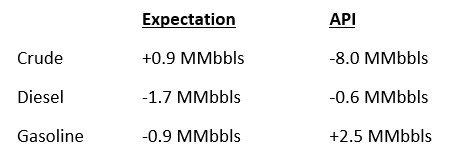

The API’s data last night:

The API reported a large surprise draw for crude of 8.0 MMbbls versus an expected build of 0.9 MMbbls. At Cushing, stocks increased by 1.0 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had an surprise increase. The EIA will report numbers later this morning.

Crude prices are down this morning. WTI Crude is trading at $37.36, a loss of $2.21.

Fuel is down in early trading this morning. Diesel is trading at $1.1089, a loss of 4.9 cents. Gasoline is trading at $1.0852, a decrease of 5.8 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.