Natural Gas News – June 25, 2020

Natural Gas News – June 25, 2020

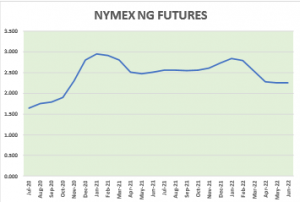

LNG Buyers Seen Rejecting Fewer U.S. Cargoes as Prices Rise

Buyers of U.S. liquefied natural gas will probably cancel fewer shipments scheduled for August than they do for July as prices show signs of recovery, according to traders. Cheniere Energy Inc., the nation’s biggest producer of LNG, received requests from buyers to forgo 16-23 cargoes for August, according to a person with knowledge of the matter. Traders surveyed by Bloomberg News speculated that cancellations from all U.S. terminals could total between 25-45 cargoes for August. The final figure is likely to be fewer than those for July, when 35-45 loadings are expected to be canceled, they said. The potential drop in canceled cargoes may signal that the global LNG market is starting to recover from the Covid-19 pandemic, which has hammered demand in an already oversupplied space. While the market is still struggling with a glut, price differences between the main U.S., Europe and Asia trading regions have started to recover ahead of next winter.

High natural gas demand on our doorstep

Record natural gas power burn may be in sight for the US power markets. Power burn is natural gas used as the fuel to run power plants to generate electricity. Hot summer temps and low gas prices is the recipe for high natural gas demand this time of year. The latest temperature outlook published by the National Weather Service indicates that the upcoming 6-10 day period as well as the 8-14 day timeframe and even the week 3-4 outlook all feature extensive regions with warmer than usual risks. There is a slight caveat to that that language though – like anything in today’s media, context is required. The ‘average’ is traditionally the 30year average.

This article is part of Daily Natural Gas Newsletter

Tagged: COVID-19, LNG, natural gas

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.