OPEC Report Shows 87% Compliance with Cuts in May

On Wednesday, WTI Crude rose sharply from lows after the bullish EIA report came out late morning. However, prices finished the day relatively unchanged yesterday, tempered by the fear of a second wave of coronavirus affecting oil demand and economies around the world. The market continues to move sideways in early trading this morning.

Yesterday, OPEC released its Monthly Oil Market Report. It showed OPEC production down 6.4 MMbpd, at 24.2 MMbpd, which is above its quota by about 925 kbpd. This production above the quota is due to Iraq, Nigeria, and Angola under-complying. OPEC+ reached 87% compliance with production cuts among OPEC members and allies in May. When asked if record output cuts need to be extended to August, Russian Energy Minister Alexander Novak said decisions about the future of the OPEC+ deal would be taken based on the supply-demand balance. On the demand side, the group left estimates unchanged despite other key agencies such as the IEA revising up 2020 demand projections this month.

The EIA reported a surprise increase for crude of 1.2 MMbbls, versus an expected decrease of 0.2 MMbbls. At Cushing, the EIA reported that stocks fell by 2.6 MMbbls. US crude oil inventories are about 15% above the five-year average for this time of year. Distillates reported a surprise draw and the 10-week streak of builds has finally come to an end. Distillates continue to trend about 28% above the five-year average. Gasoline also reported a draw in stocks and is about 10% above the five-year average.

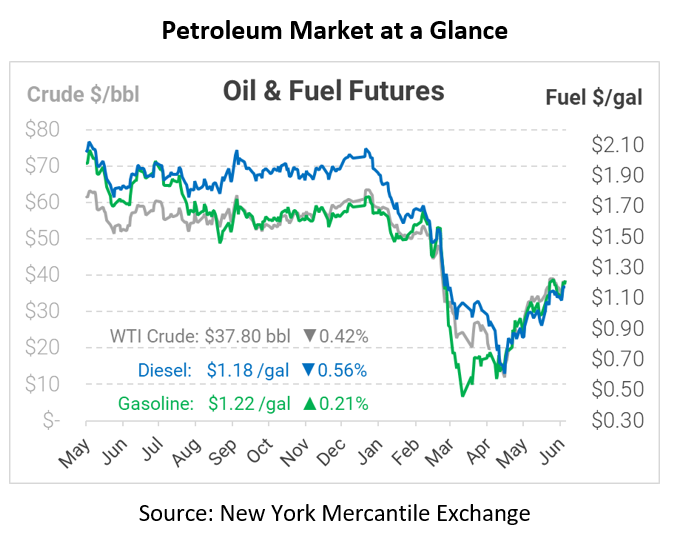

Crude prices are down this morning. WTI Crude is trading at $37.80, a loss of 16 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.1754, a loss of 0.7 cents. Gasoline is trading at $1.2178, a gain of 0.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.