Despite Strong Economic Data, Markets Fear Second Wave

On Tuesday, WTI Crude rose steadily, tracking with U.S. equities. Retail sales numbers crushed expectations and drove markets higher. In addition, the Trump administration announced further stimulus measures, and Fed Chairman Powell discussed the Fed’s plans for buying corporate bonds to support the economy. Prices are retreating in early trading this morning after a bearish API inventory report showed a surprise jump in crude inventories, raising fresh concerns about excess supply.

Bullish news was offset by growing fears of a second wave of COVID-19 infections around the world. Easing of lockdowns and the return of personal freedoms and travel has spurred the spread of the virus. While the original epicenters of cases in the U.S. had been in New York and Seattle, the new epicenters of this second wave are in the South where warm weather has brought people out to public places in droves. Beaches, parks, and other outdoor spaces have seen a resurgence of visitors, and lax compliance with social distancing and mask-wearing has led to a resurgence of cases.

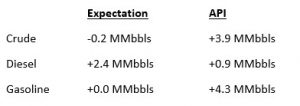

The API’s data last night:

The API reported a large surprise build for crude of 3.9 MMbbls versus an expected draw of 0.2 MMbbls. At Cushing, stocks decreased by 3.3 MMbbls. The API reported that distillates had a smaller-than-expected increase. Gasoline had a rise in inventories. The EIA will report numbers later this morning.

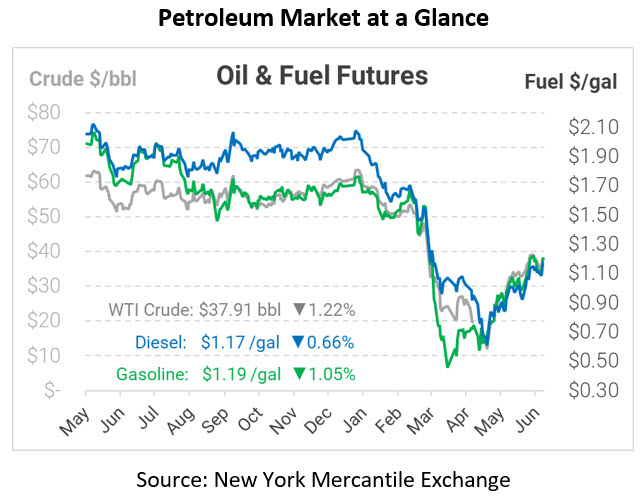

Crude prices are down this morning. WTI Crude is trading at $37.91, a loss of 47 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.1744, a loss of 0.8 cents. Gasoline is trading at $1.1946, a loss of 1.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.