Week in Review – April 3, 2020

The crude market was up for the week. Early in the week, talks between President Trump and Russian counterpart Vladimir Putin helped bring some stability to cratering markets. On Thursday, President Trump said that he had brokered a deal that could result in Russia and Saudi Arabia cutting output by 10 mmbpd to 15 mmbpd, representing 10-15% of global supply; Trump said, however, that he had not offered to cut US output.

Of course, COVID-19 continues to wreak havoc on markets. This week the US became the nation with the highest number of COVID-19 infections, causing many around the company to tighten restrictions on activities. The entire country has moved to limit interactions, and social distancing has put a heavy toll on gasoline and jet fuel demand.

OPEC+ plans to have a meeting April 6th to discuss output cuts which may be dependent on US involvement. President Trump is meeting with a group of large US oil producers today at the White House.

Prices in Review

WTI Crude opened the week at $20.93. It was flat to mid-week when it took off on news from Trump about an oil production deal. It opened Friday at $24.81, a gain of $3.88 (18.5%).

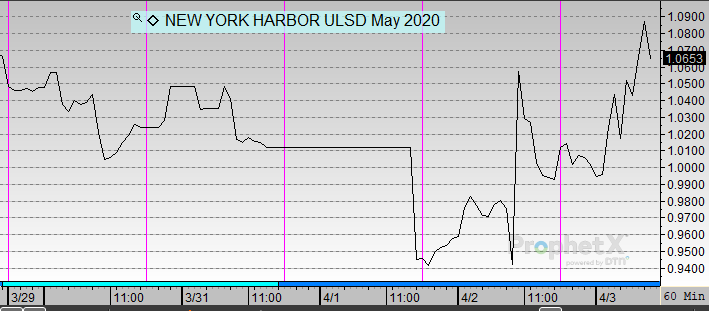

Diesel opened the week at $1.0505. It followed a downward trend to midweek at which point it recovered some of the week’s losses. Diesel opened Friday at $0.9969, a loss of 5.4 cents (-5.1%). It is recovering some losses in early trading this morning.

Gasoline opened the week at $0.5451. It had a steady climb upward through the week. Gasoline opened Friday at $0.6586, a gain of 11.4 cents (20.8%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.