“Getting VERY close to a BIG DEAL with China”

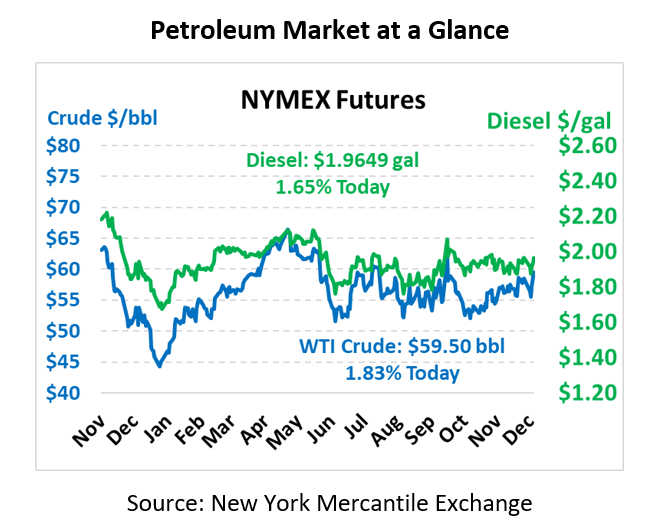

Yesterday morning brought an oil price surge as Trump tweeted that the US and China were on the cusp of finalizing a major trade deal. WTI crude briefly touched $60/bbl this morning, the highest price since the Saudi oil attack in September. Currently, crude prices are trading at $59.36, up 18 cents from yesterday’s close though off from this morning’s high.

Fuel prices are also pushing higher levels. Diesel prices are currently trading at $1.9727, up 2.2 cents from yesterday and just shy of the $2/gal threshold. Gasoline prices are at $1.6461, up 1.8 cents.

While the US-China trade deal has not yet been announced, early reports have confirmed that the US will suspend some tariffs and reduce others in exchange for more Chinese purchases of American farm goods and IP protection. Trump has reportedly signed the bill as well, though China has yet to confirm agreement on their end and is expected to speak on it this morning. Importantly, the deal will not immediately roll back all tariffs, meaning some economic friction will remain. But this “Phase 1” of the deal should at least help prevent further escalation of the trade war and provides momentum for further progress.

In other trade news this week, you may have heard that House Democrats have now endorsed President Trump’s US-Mexico-Canada Agreement (USMCA) on trade, which had been negotiated to replace NAFTA. Despite the shift in stance, USMCA still has a way to travel. The Senate is delaying a vote on the agreement until after impeachment trials come and go, and some Republicans have taken issue with the revised agreement. Most expect the deal to pass sometime next year, though some believe USMCA could go the way of the Trans-Pacific Partnership (TPP) deal that failed during the 2016 campaign season.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.