Week in Review – October 11, 2019

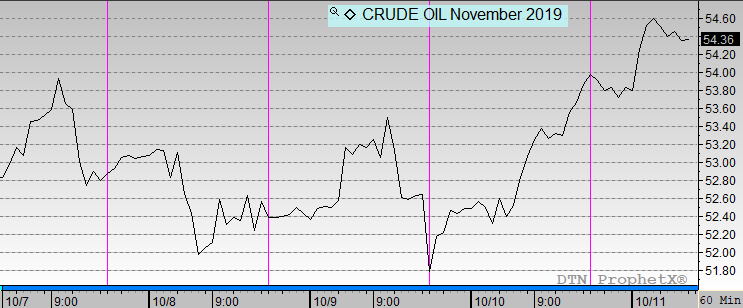

The crude market was up for the week. The big driver for the week was positive sentiment around US-China trade talks. Some reports suggest that the Chinese would be willing to accept a partial trade deal with the US – possibly increasing annual purchases of agricultural products in order to secure an interim trade deal with Washington. Trade talks began yesterday, and markets are hopeful. Later in the week, OPEC’s leader declared the organization’s commitment to balancing markets in 2020, giving traders confidence that prices may not fall much lower next year even amid economic concerns.

The EIA reported mid-week that crude stock had a larger-than-expected build. Counter to that, however, were larger-than-expected draws in refined products. With IMO 2020 around the corner, some are viewing the drawdown in diesel inventories as evidence that markets will indeed grow tighter over the coming few months. Many analysts have predicted higher oil prices due to IMO 2020, with the boldest prediction, from former presidential energy advisor Phillip Verleger, heralding $200/bbl oil within a few months.

Prices in Review

WTI Crude opened the week at $52.69. After losses through mid-week, markets have closed the week higher. Crude opened Friday at $53.88, a gain of $1.19 (2.3%).

Diesel opened the week at $1.8908. It followed crude closely through the week. Diesel opened Friday at $1.9344, a gain of 4.4 cents (2.3%).

Gasoline opened the week at $1.5706. It followed crude through the week. Gasoline opened Friday at $1.6202, a gain of 5.0 cents (3.2%).

This article is part of Crude

Tagged: 2020, Chinese, eia, IMO 2020, oil prices, opec, Phillip Verleger, trade talks, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.