US-China Trade Talks Resume

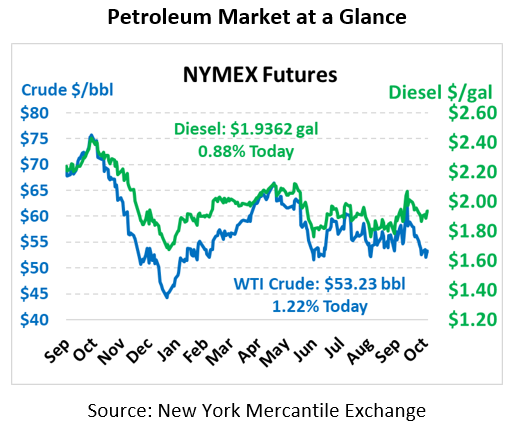

Positive sentiment regarding trade seems to be lifting markets this morning as the US-China trade talks resume. WTI Crude is trading at $53.23, a gain of 64 cents.

Fuel is up in early trading this morning. The EIA reported larger-than-expected draws in products and positive trade sentiment are helping to lift prices. Diesel is trading at $1.9362, a gain of 1.7 cents. Gasoline is trading at $1.6021, a gain of 1.5 cents.

On Wednesday, markets closed relatively flat as they weighed positive sentiment regarding US-China trade talks versus an EIA reported larger-than-expected build. All eyes are on the trade talks as they resume today. China has seemed to have lowered expectations of a deal while Trump has stated he will increase tariffs on $250 billion of Chinese goods to 30% from 25% on October 15 if there is no significant progress. Markets are up in early trading this morning as the trade talks begin.

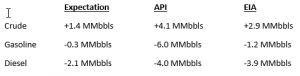

The EIA reported a larger-than-expected crude build of 2.9 MMbbls versus an expected 1.4 MMbbls. At Cushing, they had a small build of 0.9 MMbbls. This crude build was tempered by larger-than-expected draws on the products front. Gasoline had a 1.2 MMbbls draw versus an expected draw of 0.3 MMbbls. Diesel drew 3.9 MMbbls versus an expected 2.1 MMbbls expected draw.

In the San Francisco area, local utility provider Pacific Gas and Electric (PG&E) is executing forced power interruption to prevent fires. PG&E announced late Tuesday that it had cut power to 800,000 customers to keep power lines from sparking a fire after last year’s deadly fires. Refineries and terminals in the area are watching the situation and are in communication with PG&E but expect no impact to services.

This article is part of Crude

Tagged: Chinese goods, eia, fires, Pacific Gas and Electric, pricing, San Francisco, trade talks, Trump, US-China

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.