Tropical Storm Barry Passes, Market Shifts to China Focus

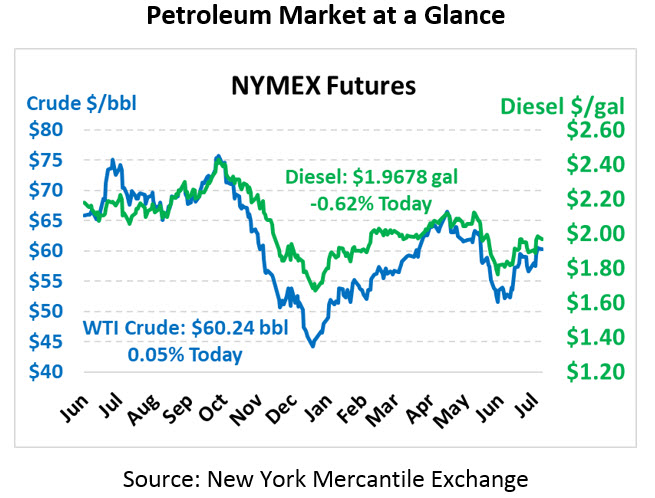

The petroleum complex is seeing mixed results following Berry’s landfall, with crude trading slightly higher while fuel prices drop. Crude oil is trading flat at $60.24, hardly moved from Friday’s close.

Fuel prices are generally lower this morning, though with uneven downside results. Diesel is currently trading at $1.9678, a loss of 1.2 cents since Friday’s close. Gasoline prices are $1.9375, a sizable 4 cent loss.

China this week released their Q2 data, revealing just a 6.2% GDP growth rate – the slowest in over two decades. Yet they also revealed a record oil consumption level of 13.07 MMbpd, a reminder that China’s growth continues to push demand higher. Industrial activity was also surprisingly high, growing at 6.3% year-over-year for June. Retails sales leapt to 9.8% growth, compared to 8.6% in May. China’s economy is quite different from the US; in the US, GDP growth is generally driven by increases in services and technology, which do not affect oil demand. Conversely, China’s growth results largely from industrial output and results in a growing middle class, both of which drive higher oil consumption. For that reason, economic growth in China is more consequential for oil demand than US growth.

Tropical Storm Barry has come and gone now from the Louisiana coastline, having made landfall on Saturday morning. While the storm did bring heavy rains and storm surge, the damage was minimal, and infrastructure is already beginning to bounce back. Some 150,000 residents were left without power this weekend, though local power companies have been quick to restore downed lines. Some flash flooding is still possible as the storm makes its way inland, so we’ll continue to monitor its affects. Refineries are resuming their operations now that Barry has weakened, so from a fuel standpoint this storm will likely pass as a non-issue.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.