Iran Tensions Broil as UAE Ship Disappears

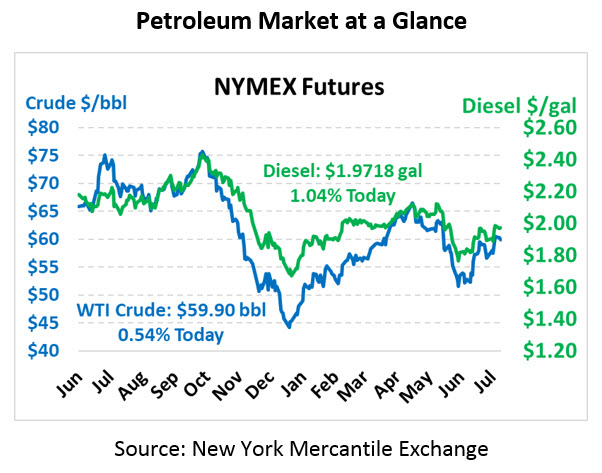

Yesterday the front end of the WTI crude price curve dipped gently as Tropical Storm Barry came and went with no long-term affect on fueling infrastructure. Today, though, the market complex appears to be pushing upwards again, with moderate gains across the board. Crude oil is currently trading at $59.90, up 32 cents.

Fuel prices are trading in line with higher crude prices. Diesel prices are trading at $1.9718, up 2 cents from yesterday’s close. Gasoline prices are $1.9471, up 1.7 cents.

Following yesterday’s news about Tropical Storm Barry and weak GDP growth in China, today has been rather quiet in the news. US retail sales rose in June even as gasoline prices fell, demonstrating the continued strength of consumer spending even as economists call for weaker growth.

On the international front, reports are coming out of a UAE oil tanker that turned off its transmitters after floating into Iranian territory while commuting through the Strait of Hormuz, adding to fears that Iran is actively intervening in oil shipments through the major world oil chokepoint. So far neither Iran nor the UAE have made any statement on the disappearance. The disappearance comes after Iran’s threats to retaliate following the British capture of an Iranian oil vessel in violation of US sanctions. Iran has also offered to negotiation with the US regarding its ballistics missile program, on the condition that US arms sales to Saudi Arabia and the UAE halt first.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.