Expected Economic Slump Weighs on Oil

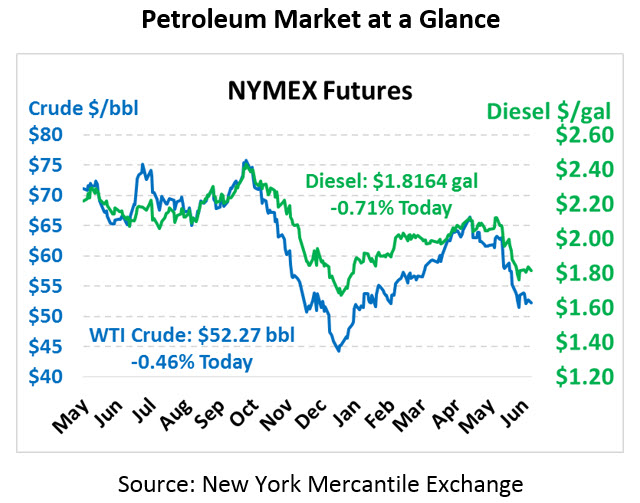

Markets continue trading within their relatively low range, with crude still drifting between $51 and $53. The weekend was light on fundamental market changes, leaving traders to continue speculating over economic concerns and OPEC cuts. Crude oil is trading at $52.27 currently, down a small 24 cents.

Fuel prices are also dipping lower today. Diesel prices are trading at $1.8164, a loss of 1.3 cents from Friday’s close. Gasoline prices are $1.7142, down 1.8 cents.

Globally, economic data continues to disappoint. In China, industrial output reached a 17-year low amid the trade dispute with the US. India saw fuel demand grow nearly flat with last year, a sign of slowing growth in one of the fastest industrializing countries in the world. Over the weekend, India announced 70% tariffs on 28 US products, presumably in retaliation to the US removing India from a preferential trade agreement that exempted $6 billion of goods from tariffs. Although India’s tariffs apply to just $240 million in goods, the measure could be a foreshadowing of a new trade war waged between the US and India.

Bank of America recently dropped its oil demand growth prospects for 2019 down to just 930 kbpd overall, one of the first analyst groups to drop their forecast below 1 MMbpd. The bank cut its WTI crude forecast substantially, citing possibilities that the US-China trade war will lead Chinese companies to resume purchases of Iranian oil, bringing excess supplies to the market. The bank also notes three bullish factors that could prop up oil prices if the economy falls too hard: interest rate cuts by the Fed, production restraint from Saudi Arabia, and a trade deal with China.

FN Price Survey

On Friday we polled our audience to gauge sentiments on price directions. When asked whether we’ll see $45 or $65 next for WTI, 58% predicted that $45 is the target for WTI crude prices. What do you think? If you haven’t cast your vote yet, check out yesterday’s FN article to share your views.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.