Trade Deal is Back on the Table

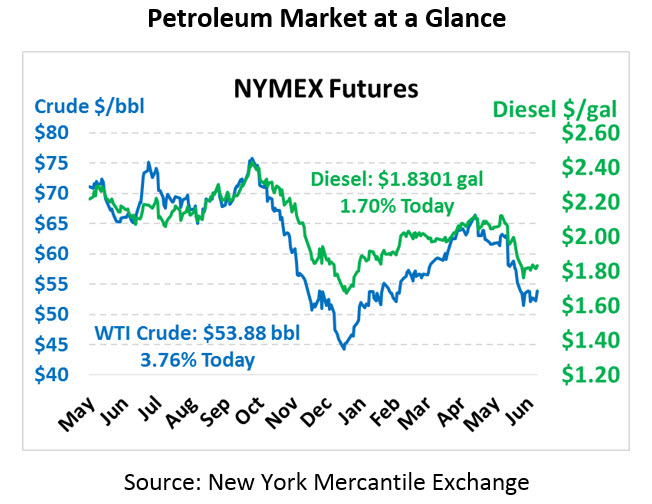

Oil markets, along with equities, are leaping higher this morning following positive trade news. Driven by a larger market surge, crude oil is currently trading at $53.88, up $1.95 (+3.8%).

Fuel prices are also getting a lift. Diesel prices are trading at $1.8301, a 3.1 cent increase (+1.7%). Gasoline prices are $1.7229, up 3.2 cents (+1.9%) from Monday’s close.

This morning Trump tweeted that trade talks will resume with China at the G20 summit at the end of June, with negotiators meeting ahead of the event. Many had given up hope of a trade deal in the near future, so renewed potential of a deal had markets trading sharply higher. So far, the US has imposed 25% tariffs on $250 billion of Chinese goods, threatening to hit another $300 billion if the Chinese don’t come to the negotiating table.

In oil news, Trump yesterday hinted that oil access would not be enough to trigger a war with Iran. His comment comes as Iran has threatened to cut off oil transit through the Strait of Hormuz, the world’s largest oil chokepoint. Trump specifically called the recent attack in the Gulf of Oman a “minor attack”. Few analysts believe there’s much credibility behind Iran’s threat to shut the Strait, given the severe consequences the international community would impose and strategic oil reserves held by most major economies.

In the Midwest, flooding has causes some severe issues for the ag business, leading to just 92% of the corn harvest and 77% of the soybean harvest being planted according to a USDA report. In most years prior, planting would be done or nearly done at this point in the year, leaving a lot of ground to make up. Moreover, many planted simply to fulfill insurance obligations, meaning a harvestable crop is not the intended goal. What does this mean for fuel? Each year, the Midwest sees diesel prices pop in the fall as farmers harvest their crops. A small harvest may mean a less severe fall pop in basis prices, keeping Midwest fuel prices lower in the months to come.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.