Oil Trades in Narrow Range on Trade Woes and Tight Supply

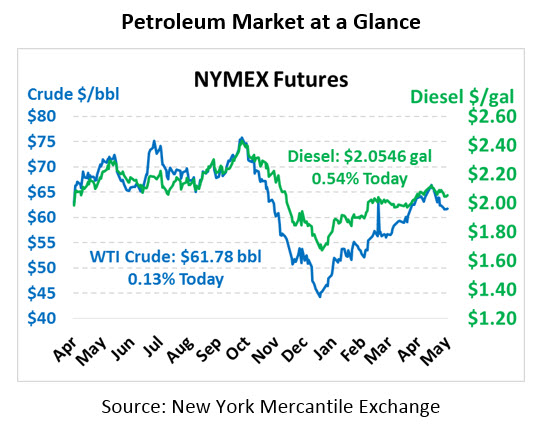

Yesterday’s market slowed its descent, though still ending in the red. Crude oil this morning is trading flat, up just 8 cents at $61.78.

Unlike crude, fuel prices are trading a bit higher this morning. Diesel prices are $2.0546, up 1.1 cents. Gasoline prices are pushing against the $2/gal level again, trading up 1.7 cents at 1.9928.

The trade war between the world’s two largest economies continues to weigh on markets. Despite a “beautiful” letter from the Chinese, Trump hiked tariffs on half of Chinese imports from 10% to 25%, while the other half remains tariff-free for now. However, the new rates apply only to new imports, not those already scheduled to delivery; since it takes roughly two weeks for deliveries, negotiators have some time to potentially avert tariffs before they go into full effect. Goldman Sachs analysts estimated that tariffs on the remaining $300 BN in Chinese imports have just a 30% chance of going into effect, as it will take time logistically to prepare those tariffs. Market participants are still hopeful for a deal being completed, which would help jumpstart the global economy.

Despite bearish pressure from the trade war, prices have been unable to break lower given supply concerns. Satellite data reported on by Bloomberg shows that Iran has not exported a single cargo-ship since waivers expired, meaning less oil available on the international stage. Venezuela, of course, has very poor prospects of resuming higher production anytime in the near future. Shorter-term disruptions in Russia and Nigeria have also contributed to higher prices, leading traders to pay large premiums for tight near-term supplies.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.