US-China Trade Weighs on Prices

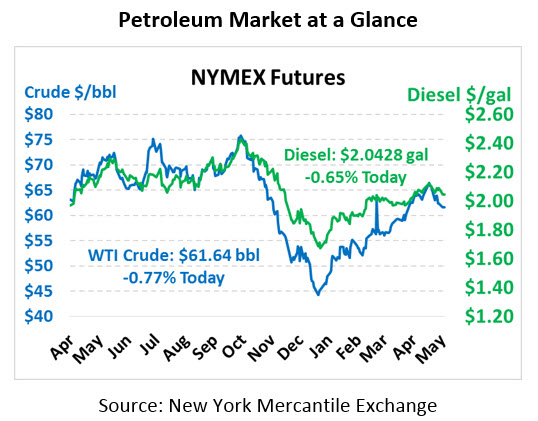

Prices rose roughly 1% yesterday following constructive data from the EIA. This afternoon, however, prices are heading lower once more, burdened by US-China trade consternation. Crude oil is currently trading at $61.64, down 48 cents.

Fuel prices are also printing in the red this afternoon. Diesel prices are trading at $2.0428, a loss of 1.3 cents from yesterday’s close. Gasoline prices are $1.9700, a less severe 0.5 cent loss.

The EIA reported yesterday that crude stocks fell by 4 million barrels, a sharp variance from the expected build. Activity for the week was lower overall, with production, imports, exports and crude runs all a bit lower – but imports, which fell 700 kbpd from last week, were the real driver of the draw. Notably lower was refinery utilization, which dipped to 88.9% for the week as many refineries struggle to complete repairs and resume normal operations. Gasoline and diesel stocks saw very small draws, though far less movement than expected.

The world continues watching the unfolding drama of US-China trade. Trump has now indicated that China “broke the deal” in some manner, leading to escalating tariffs on Friday as the Chinese trade delegation meets with US counterparts in DC. Already, China has imposed tariffs on nearly all of the $112 BN in goods shipped from the US annually, while the US has imposed tariffs on roughly half ($250 BN of $540 BN) of Chinese imports. In terms of tariffs, the US clearly has more room to run than China, meaning China could retaliate against new tariffs with non-tariff measures. With the world’s two largest economies hanging in the balance, the US-China trade war could easily grow to dominate the global economic landscape this year.

Farther from the headlines, Libya remains embroiled in civil war as opposition forces attempt to take over the government. Tens of thousands of Libyans have been displaced as a result of the conflict. Head of Libya’s National Oil Company warned that severe disruptions were highly probable if fighting continues. Libya exports over 1 MMbpd of oil, accounting for roughly 1% of global supply, so any disruption could have severe consequences for global oil prices. Libya has been labelled one of the largest price risks in 2019, given the unpredictable nature of an outage.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.