Shutdown Could Cause 0% GDP Growth in Q1

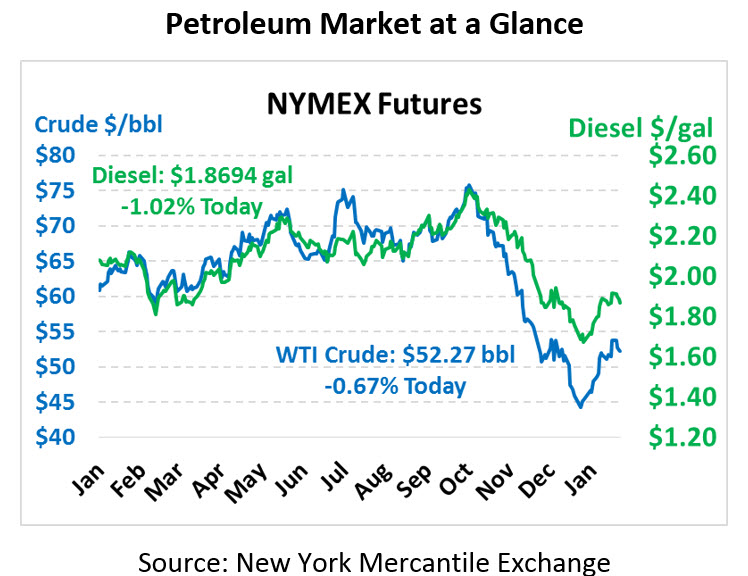

Oil is trading slightly lower this morning as a bearish API report caused concerns of sustained oversupply. Crude is currently trading at $52.27, down a meager 35 cents.

Fuel prices are also trending a bit in the red, with steeper losses for diesel than gasoline. Diesel prices are trading at $1.8694, having shed 1.9 cents since yesterday’s close. Gasoline prices are $1.3796, down just 0.6 cents.

The government shutdown continues to impact federal spending, and 800,000 workers are expected to miss their second paycheck tomorrow. Trump’s economic adviser Kevin Hassett predicted GDP growth in Q1 could be 0%, though clarifying that lost growth in Q1 would merely be pushed to later quarters. S&P Global Ratings estimates the shutdown costs the economy roughly $1.2 BN per week.

The API’s report released last night was decidedly bearish, with across the board builds in the petroleum complex despite some expected draws. Crude specifically, which was expected to remain flat, is showing a 6.6 million barrel build. The EIA’s report this morning should provide some more light on whether markets remain as oversupplied as the report suggests.

Venezuela Spotlight

Venezuela, the 4th largest supplier of crude to the US, has seen significant volatility recently. Crude oil production has plummeted over the past few years as Venezuelan president Nicolas Maduro dragged the country into authoritarianism and economic decline. The US has considered sanctioning the regime on numerous occasions, but economic conditions have grown so dire the US did not want to further exacerbate the situation.

Yesterday, the head of Venezuela’s National Assembly Juan Guaidó declared Maduro’s presidency illegitimate, making him the interim President. America quickly recognized Guaidó as the interim president, leading other countries to follow suit. Maduro has cut off diplomatic ties with the US, ordering diplomats to leave the country over the next 72 hours.

While the US has supported Guaidó, the move does little to change the situation within the country. Security forces have thus far remained loyal to Maduro, and the international community is hesitant to intervene. Many global leaders have a “You break it, you bought it” mentality with Venezuela – anyone who intervenes will take the blame and be responsible for the clean-up once the situation cools.

As a major global oil producer, the instability within the Venezuelan regime threatens oil prices. Although Venezuela has already seen significant reductions in their output, December data still shows 1.5 MMbpd of production (down from 3.0 MMbpd in 2014). If the US places sanctions on Venezuelan crude, it could push up American oil prices significantly. More importantly, the instability creates business uncertainty, causing major oil companies to withdraw from Venezuelan oil investments. On the flip side, if Guaidó can successfully consolidate power and create more stability, it could lead to an increase in oil production and an easing of global oil prices. Venezuela will be an important player to monitor throughout 2019.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.