Markets Continue Decline Amid Economic Concerns

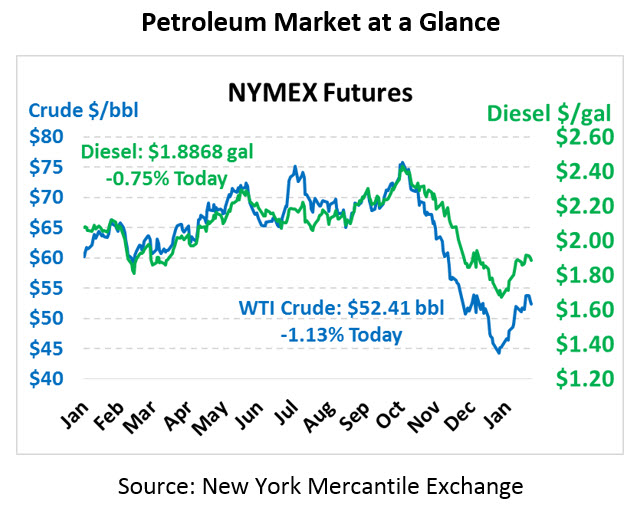

Yesterday brought a strong downturn as equity weakness spilled over to the broader market. This afternoon that weakness continues, though at a smaller scale. Crude oil is currently trading at $52.41, a loss of 60.

Fuel prices are also solidly in the red today. Diesel prices are trading at $1.8868, down 1.4 cents from yesterday’s close. Gasoline prices are $1.3819, down 2.0 cents.

Adding to the overall market pressure was a report from Saudi Arabia revealing that they increased November production by 500 kbpd relative to October. The numbers confirmed what was generally already known, and in December the country cut production back significantly. Still, the reminder of recent supply increases helped alleviate market concerns of tightness.

Conflicting reports about US-China trade have left markets in a frenzy. Rumors held that an upcoming meeting between the US and China had been cancelled (signally stalled talks), but the president’s chief economic advisor corrected the perspective by saying preparations are underway for that meeting. Markets are increasingly looking to US-China trade talks as a sign of the overall economy – if trade talks are resolved, markets will get a huge shot in the arm compared to current levels.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.