Trump Drops the Hammer on Russia

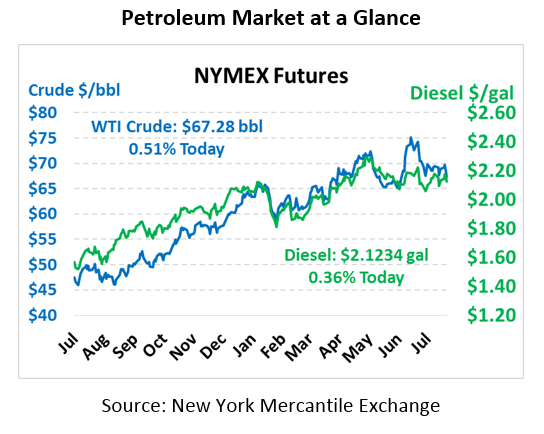

Volatility continues with markets plummeting over $2/bbl lower yesterday, which has become almost commonplace over the past couple months. Steady gains give way to large losses, creating an endless back and forth. Crude closed at $67.28 yesterday, and this morning is trading just 38 cents higher as markets evaluate how to move forward.

Fuel prices also collapsed in the face of fuel stock builds. Diesel prices gave up 5.3 cents, and gasoline once again took the bigger hit with an 8.5 cent loss. This morning diesel prices are trading at $2.1234, up 0.8 cents from yesterday. Gasoline prices are trading at $2.0076, continuing the streak of losses by giving up 1.2 cents today.

The EIA released their weekly inventory data, and the markets took the data to heart. Although crude stocks declined by 1.4 million barrels, both gasoline and diesel stocks rose. The EIA reported smaller builds than the API’s data, but markets still went into a sell-off.

Amplifying the sell-off was concerns over demand. Gasoline demand fell by over half a million barrels per day this week, and was 450 kbpd lower than the same week last year. Diesel demand rose relative to last week, but was still half a million barrels per day below last year at this time. Refinery utilization remains incredibly strong, picking up half a percentage point to reach 96.6%. That means refineries are producing lots of fuel, but demand is down, creating excess supplies and causing lower prices.

While the EIA’s data was decidedly bearish, the news wasn’t all that way. Yesterday China declared that crude oil would not be included in the tariff dispute, though fuel products would be. Chinese buyers have been avoiding WTI crude imports given the threat of tariffs, which may have impacted exports slightly over the past months. Although not a huge announcement, it should help support WTI crude prices even as it works against gasoline and diesel prices.

The US imposed sanctions against Russia yesterday following the use of nerve agents on a Russian double agent, though Russia denies the allegation. Chemical weapons are highly frowned upon internationally, which is why the US’s response was so severe. Sanctions ban Americans from exporting certain sensitive goods and technologies, which could include some used by Russia’s oil and gas sector to increase production. If so, the net result of the sanctions would be less Russian production, which would overall support higher oil prices globally. The exact nature of the sanctions is still being evaluated to see if Russia’s oil industry will be affected.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.