$2 Increase for 2019 Crude Price Forecast

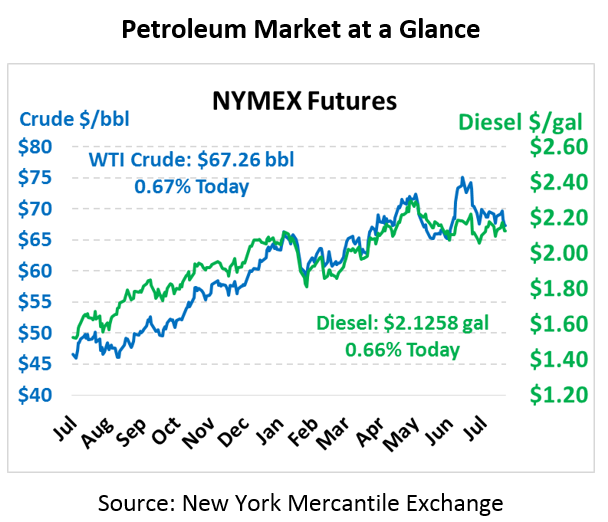

The oil complex is trading back in the black this morning following the sharp mid-week losses. Crude oil traded mostly flat yesterday, closing only 2 cent higher than it opened. This morning, prices have gained 45 cents to trade at $67.26 currently.

Fuel prices are also trading in positive territory this morning. Both products saw traded mostly flat yesterday though gasoline made more upward progress than diesel. This morning, gasoline prices are continuing to move higher trading at $2.0203, a gain of over 2 cents. Diesel prices have gained over a penny at $2.1258.

While both products have experienced losses over the past two weeks, diesel has remained more stable than gasoline on a week-over-week basis. Diesel is down just 2 cent from last week’s opening price and only 6 cent from 2 weeks ago while gasoline has fallen by 16 cent for the same time period. The major loss in gasoline prices can be mostly attributed to inventory levels. High refinery utilization and lower demand are creating a build in product inventories, putting downward pressure on prices. While diesel inventories are sitting near 5-year lows, gasoline inventories are still near 5-year highs, keeping a lid on gasoline prices.

EIA Short-Term Energy Outlook

The EIA published its monthly energy outlook report earlier this week. EIA estimates that U.S. crude oil production averaged 10.8 million barrels per day in July, up 47,000 b/d from June. U.S. crude oil production is forecast to average 10.7 million b/d in 2018, and will average 11.7 million b/d in 2019.

The EIA now forecasts Brent crude oil prices to average $71 per barrel and WTI crude oil prices to average more than $64/b in 2019. Both of these forecasts are $2/b higher than the forecast from the July STEO. The higher price forecast reflects a lower forecast for global oil supply in 2019 that was only partially offset by lower forecast oil demand for next year.

U.S. regular gasoline retail prices averaged $2.85 gallon in July, down 4 cents from the average in June. EIA expects prices to remain relatively flat in the coming months, averaging $2.83 in September, and averaging $2.76 in both 2018 and 2019. Diesel prices are forecast to average $3.15 in 2018 and $3.11 in 2019.

There are a variety of potential price risks expected to impact these forecasts. Upside price risks stem largely from the possibility of supply outages when both petroleum inventories and spare crude oil production capacity for OPEC members are lower than average. Downside price risks stem largely from potentially reduced demand because economic growth and resulting crude oil demand could be lower than forecast.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.