Price Weakness Following Dollar’s Rise

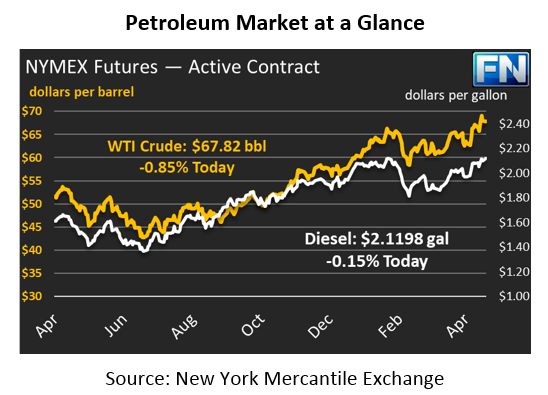

Crude oil ended the day on Friday mostly unchanged, while fuel prices managed to eke out some small gains. Today, oil prices are trending sharply lower thanks to a strengthening US dollar. Oil prices are currently trading at $67.82, a loss of 58 cents (0.8%) since Friday’s close.

Fuel prices are mixed this morning. Diesel prices are trading lower in sympathy with crude prices, at $2.1198, down 0.3 cents from Friday. Gasoline prices are $2.0974, a slight gain of 0.1 cents.

The dollar has been the primary market mover this morning. The dollar is trading at it’s highest level since early March. Several factors are helping the dollar stay elevated this morning – strong retail sales, relatively weak global economic data, rise of Treasury yields, and a lack of new geopolitical issues.

A rising dollar means traders in other countries must spend more of their native currency to buy dollars in order to trade in oil markets. Because their native currency does not go as far, they cannot buy as many barrels of oil, reducing demand and causing lower oil prices.

Also contributing to today’s losses, Baker Hughes reported on Friday that U.S. rigs rose by 5 rigs, bringing the grand total to 820, the highest count since March 2015. Rising rig counts show that U.S. producers have yet to slow down their historic production increases, which may keep a lid on oil prices.

In international news, Russia, China and France have all declared their support for the existing Iran deal. The countries will try to upend Trump’s efforts to negotiate for a new deal by imposing sanctions on May 12. Iran has been a key market driver lately, with some analyst groups saying that as much as $5 of current oil prices are attributable to uncertainty about the Iran nuclear deal. If Trump fails to extend waivers in May, prices could increase by another $5 due to the disruption of Iranian oil flows.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.