The Best Cure for High Prices?

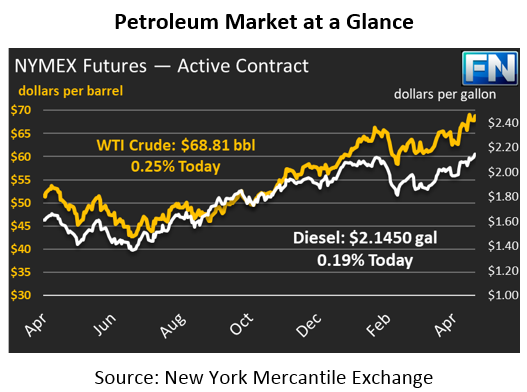

Oil prices ended Monday higher despite the fundamentals working against it. The dollar rose, while equities fell, both generally predictive of weaker oil prices. Oil began with some morning losses, but recovered to end the session up by almost 30 cents. Today, crude prices are still trading in positive territory, picking up 17 cents to trade at $68.81.

Fuel prices also got a boost yesterday, with diesel prices gaining nearly 2 cents and gasoline prices leaping almost 3 cents. Today, both products are experiencing small gains. Diesel prices are trading at $2.1450, up 0.4 cents since yesterday’s close. Gasoline prices are at $2.1278, also up 0.4 cents.

Another bearish trend from yesterday was European countries announcing their support for the Iran nuclear deal. The EU is working to change Trump’s anti-Iran position. If Trump fails to extend the sanction waivers on May 12, it would disrupt the Iran deal and cause the U.S. to reimpose sanctions. Other nations are not required to follow suit, but the breach from the U.S. would likely trigger a response from Iran as well, forcing European allies to make a tough decision. Yesterday’s headlines reveal that Trump is receiving pressure from allies to remain in the deal.

The fact that prices rose despite bearish trends shows how strong the current oil rally is. Hedge funds are convinced that oil prices are heading to $80, and are jumping in the market now to capitalize on as much profit as they can. On the flip side, large fleets should be considering how they avoid that high-end risk by speaking with their fuel supplier about risk management tools.

The Best Cure for High Prices is High Prices (Or Maybe Not…)

This common saying from analysts is a nod to the impact that higher prices play on demand. As prices rise, consumers tend to find ways to reduce consumption, whether by using alternative fuels or by cutting back on trips. With fuel prices more than double their 2016 lows, will high oil prices become their own worst enemy?

Back when prices were around $50/bbl, analysts warned that OPEC should be restrained in their cuts – if prices rose too high, American producers would swarm in and consumers would cut back on demand. At the time, $55 WTI crude oil (or $60 Brent) was the upper limit of what analysts thought the market would allow. Anything above this would unleash American production and scare away consumers.

Yet American producers are growing at roughly the same pace they grew when prices were $50. With lower break evens, any price above $50 helps U.S. producers earn profits. At the same time, the economy was weaker when oil was at $50 early in 2017. With so many factors changing, will high prices really lead to demand reduction?

OPEC does not believe demand will fall. The economy is experiencing robust growth that won’t be slowed by (still historically average) oil prices. More importantly, despite the influx of new American production, analysts warn that by 2019 demand growth could far outstrip supply, as old wells are retired and new wells are not available to replace them. Goldman Sachs warned that Brent crude oil will rise to $82.50 this summer, up from the current low-$70’s range.

While high prices usually cure themselves by incentivizing more production and lower demand, markets appear to have plenty of room to run before any slowing down occurs.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.