Weekend Summary

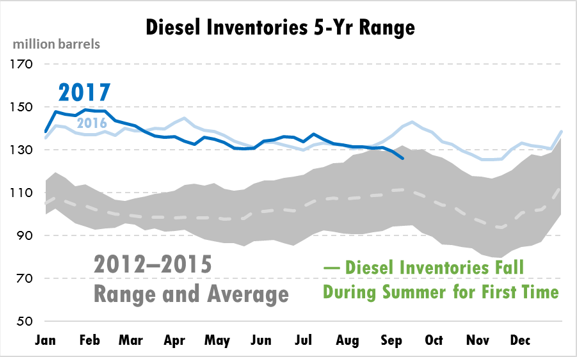

Storm Worsens Unprecedented Summer Slump in U.S. Diesel Supply

Diesel inventories have declined this summer, dropping to three-year lows for this time of year. Refineries typically build stocks in the summer to prepare for high demand in the fall (agriculture harvest season) and winter (heating oil), but this year they’ve been unable to stock up because of Harvey. Click Here to read more from Reuters.

California Refiners Struggle in a State that Wishes They Would Go Away

Refineries in California face a bleak outlook – gasoline demand is falling and diesel fuel is flat, driven by high taxes and regulatory fees. Even worse, the stringent spec requirements in California make the fuel too expensive to sell profitably elsewhere. California refiners are in a tight spot, so how do they stay in business? Click Here to find out from RBN Energy.

The Boring Truth about Oil Prices

While oil markets move ever second during the trading day, the long-term expectations for oil prices is relatively stable now. While price forecasts used to fluctuate from $20-$80, nearly all price forecasts for 2018 are between $45 and $60. This low-volatility environment has led investors to search for other markets with more profit potential, further decreasing price volatility. As money leaves the industry, oil companies will have to slash costs in order to weather the low price environment expected in 2018. Click Here to read more from Oilprices.com.

Saudis May Raise Domestic Gasoline Prices by 80%

Saudi Arabia is considering an increase in gasoline prices, in the form of phasing out subsidies, as the country gears up for lower revenues from oil in coming years. Saudi Arabia has some of the lowest gasoline prices in the world, with prices below $1/gallon according to GlobalPetrolPrices.com. The increase would send prices The impact on domestic demand could also be a factor; with the OPEC cuts measured on production, not exports, countries have been looking for ways to cut production while still maintaining high-revenue export opportunities. Click Here to read more from Bloomberg.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.