Today’s Market Trend

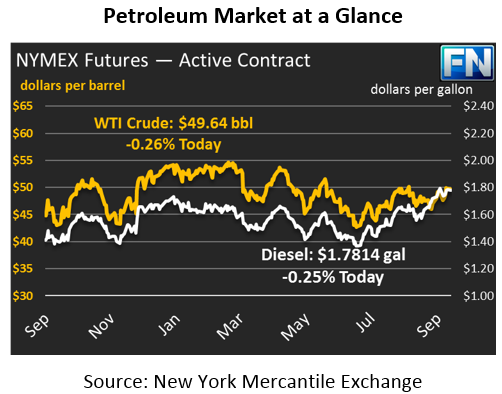

Crude prices remain mostly flat, down just $.25 this morning to $49.64 compared to Friday’s close. Crude markets gained $2.31 last week, but Friday’s trade was mostly steady. Markets have dipped slightly lower this morning, but the general market sentiment has been bullish lately.

Refined products are once again mixed. Diesel prices are $1.7814, down from Friday’s two-year high close of $1.7988. Prices Friday and this morning have peaked above $1.80. In today’s weekend summary, we include an article summarizing the strength in diesel prices.

Gasoline prices, which have been all over the place recently, gained over 3.5 cents (2.2%) on Friday, ending the day at $1.6617. Prices today are in line with that price, still at $1.6631. Markets continue awaiting the full restart of refineries in the Gulf; 15 of 20 are full operational or nearly so, but five refineries are still undergoing repairs. Prices have had a seven cent range over the past week, which has been unusual compared to this year’s price stability but makes sense following two major hurricane disruptions.

Recent news has been decidedly bullish for prices. Both Nigeria and Libya have seen major supply disruptions over the weekend, capping their output significantly. In the U.S., rig counts declined by 7 rigs, the fourth decline in the past five weeks. Low oil prices continue to cause a deceleration in U.S. oil production.

Despite the bullish news, technical analysts are calling for a correction in crude prices. Based on historical performance, betting against crude rising above $50 has been a solid bet over the past coupe years. According to a CNBC article from last week, crude prices have fallen in about 70% of weeks following a peak above $50. Whether this will hold true or not is anyone’s guess, but if the past holds true, expect to see the same up-and-down from oil prices in the coming weeks.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.