Gasoline and Diesel Retail Prices

The EIA released its weekly retail gasoline and diesel prices yesterday. Prices were broadly higher, with only a few regions seeing falling prices. Nationally, diesel prices rose by $.009 on average, while gasoline prices rose by a more substantial $.037.

Diesel prices, which rose $.009 this week, were up in all regions except PADD 4 Rocky Mountain, which saw prices fall by a small $.001. the East Coast was virtually unchanged, gaining $.001 in the Central Atlantic Region and remaining stable elsewhere. The highest gains came from the Midwest, with a rise of $.018, which was driven by a higher local basis price (more on that when we discuss gasoline).

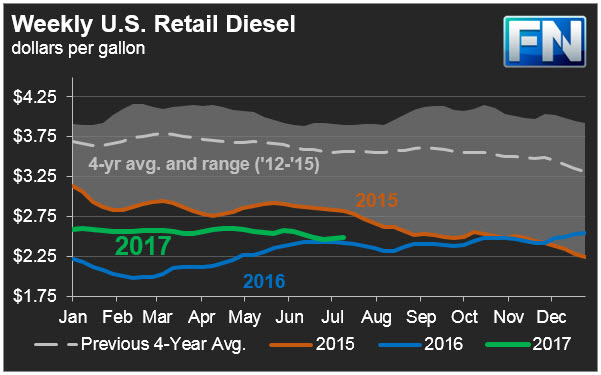

Overall, diesel prices are roughly $.067 higher than 2016 prices. Given their general downward trend throughout this year, it had looked like 2017 prices might dip below their 2016 corollary, but prices appeared to have bounced off 2016 levels in late 2016 before rising higher. Regardless of which is higher, prices have remained relatively low, below their 2012-2015 levels, bringing savings to consumers.

National gasoline prices rose dramatically this week, rising $.037 to reach $2.297. Prices were driven higher by Midwest prices, which spiked $.086 higher during the week. Prices were pushed far higher by downtime at the Coffeyville, KS refinery, which has a 115 kbpd (4.83 million gallons per day) output. The refinery is scheduled to resume operations today or tomorrow, which should help bring Midwest prices down next week.

Absent the Midwest price hike, gasoline prices were relatively mild. Prices rose $.026 in the Gulf Coast and $.019 in the East Coast, but fell in the Rocky Mountains and New England area. Overall, prices are very close to their 2016 levels. Since gasoline consumption affects demand far more than diesel prices, low gasoline prices have given the market hope that summer demand will be high, helping to trim down inventories.

This article is part of Diesel

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.