Week in Review: Oil Prices Tick Up as Market Weighs Conflicting Trends

Oil prices are up slightly to close the week, influenced by fading hopes for a quick resolution to the Ukraine war, which could have increased Russian energy supplies to Western markets. Brent crude rose $0.18 to $70.06 per barrel, while WTI climbed $0.17 to $66.72 per barrel.

Russia’s conditional support for a U.S.-proposed ceasefire and the expiration of a U.S. license for energy transactions with Russian banks have heightened uncertainty in the market. The license, General License 8L, expired as scheduled, blocking Russian banks like Sberbank and VTB from accessing U.S. payment systems. Initially issued by the Biden administration in January as part of sanctions targeting Russia’s oil and gas revenues, the wind-down was coordinated with Trump’s incoming team to strengthen Ukraine’s position in negotiations. The sanctions also prohibit dollar transactions with Russian energy firms and restrict 183 vessels involved in Russian oil transport.

The U.S. Treasury Department is considering further sanctions on Russian oil companies and service providers, potentially complicating global petroleum transactions. In response to sanctions risks, Chinese firms are reducing Russian oil imports.

The International Energy Agency (IEA) warned of a potential global oil surplus of 600,000 bpd in 2024, driven by rising U.S. production and weaker demand. Trade tensions and macroeconomic instability have led the IEA to lower its demand forecasts. Crude prices fell earlier in the week due to concerns over a trade war, with potential U.S. and EU tariffs adding to market pressures. If OPEC+ increases production beyond April, the surplus could grow further, adding to bearish sentiment in the oil market.

Prices in Review

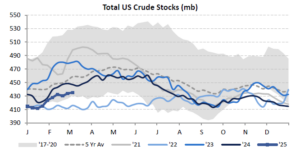

The future of fuel prices is dependent on several competing bullish and bearish trends at play in the market right now. On the bullish side, relatively low crude inventory levels in both the U.S. and global markets support higher prices, as any supply disruptions could have an outsized impact. Additionally, if ongoing tariff wars are resolved, the U.S. economy may see renewed growth, increasing energy demand. However, global conflicts, especially in Ukraine and the Middle East, could escalate further, disrupting supply chains and adding geopolitical risk premiums to oil prices. Meanwhile, U.S. crude production has stagnated, limiting the potential for a supply-driven price increase. More sanctions on Venezuela and Iran could also tighten supply, further increasing prices.

Conversely, bearish trends such as continued sluggish trade activity are keeping fuel demand lower, while OPEC is expected to increase production in April, potentially easing supply concerns. The ongoing threat of a recession could further dampen demand, as economic slowdowns typically lead to reduced fuel consumption. If peace negotiations between Russia and Ukraine were to succeed, it would likely stabilize markets and remove some of the geopolitical risk premium in oil prices. Global demand concerns, particularly in China, continue to weigh on market sentiment, as the world’s largest energy consumer faces economic headwinds.

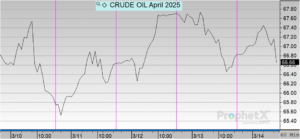

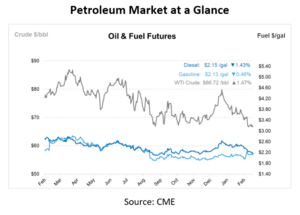

Crude prices opened at $67.11 on Monday and experienced fluctuations throughout the week. Prices dipped to $65.95 on Tuesday before rebounding slightly to $66.62 on Wednesday. The upward trend continued on Thursday, reaching the weekly high of $67.69. However, crude edged lower again on Friday, opening at $66.78. Overall, crude saw a weekly decrease of $0.33 or 0.49.

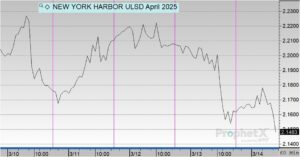

Diesel prices opened at $2.2121 on Monday and saw fluctuations throughout the week. Prices dipped to $2.1794 on Tuesday before rebounding slightly to $2.2090 on Wednesday. The market remained relatively stable on Thursday at $2.2078 before sliding again on Friday to $2.1789, marking the weekly low. Overall, diesel saw a weekly decrease of $0.0332 or 1.50%, reflecting continued demand concerns and uncertainty around global economic conditions.

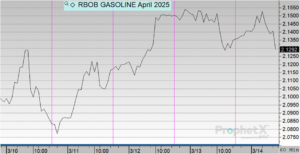

Gasoline prices opened at $2.1075 on Monday. Prices dipped to $2.0858 on Tuesday before rebounding to $2.1159 on Wednesday. The upward momentum continued on Thursday, reaching the weekly high of $2.1497, before slipping slightly to $2.1340 on Friday. Overall, gasoline saw a weekly increase of $0.0265 or 1.26%.

This article is part of Week in Review

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.