Could Fuel Price Changes Wreck Your Budget? Fixed Price is the Key to Budget Certainty

As we look ahead to 2025, many businesses are in the process of planning their budgets. One of the biggest concerns for fleet owners and operators is forecasting fuel price changes. Fuel is often one of the largest expenses for these businesses, and predicting what it will cost over the course of the next year can be challenging.

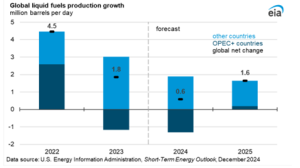

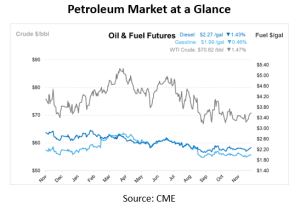

According to Andy Milton, SVP of Supply and Distribution at Mansfield Energy, forecasts indicate that 2025 may see an oversupply of fuel, potentially keeping prices lower, but there are factors at play that could cause prices to rise as well. A strong economic recovery or unexpected geopolitical events could lead to price hikes despite the current forecast. With so much uncertainty in the fuel market, businesses can find it challenging to plan. That’s where a fixed price strategy can play a significant role in budget certainty.

When a company locks in a fixed price for fuel, it essentially shields itself from market fluctuations. The price is agreed upon in advance, providing a predictable cost for the entire length of the contract. This gives companies the ability to accurately forecast their fuel expenses and plan their budgets without the anxiety of sudden price increases.

What is Fixed Pricing?

A fixed fuel price is a way of buying fuel that keeps your fuel costs under control. You set a price, or a price range, with your fuel supplier, and you have the guarantee that your fuel will be the same price no matter what happens in the marketplace. Prices rise to $5/gal? No problem, you locked in at $3.65 a few months ago.

The volatility of fuel prices—sometimes driven by geopolitical issues, seasonal demand spikes, or natural disasters, as we mentioned before —can negatively impact budgets that have already been stretched thin. Not convinced yet? Think about how the economy has affected demand for fuel in the past few years. The COVID-19 pandemic, for example, led to reduced demand due to lockdowns and fewer commuters. This, in turn, drove fuel prices changes (down) in some regions. However, as economies recovered and demand rebounded, prices rose again. Do you want to keep risking your budget?

The Benefits of Locking in Fuel Prices

While no one can predict the exact trajectory of fuel price changes, the certainty provided by a fixed price contract allows for better financial stability. In an industry where margins can be tight, that stability is invaluable.

Mac Cullens, Head of Pricing at Mansfield Energy, explains that fixed-price contracts can also help streamline internal processes. “Instead of regularly reviewing market prices, adjusting purchase orders, or worrying about fuel price changes, with a fixed price contract, you can focus on your core operations,” explains Mac, adding that “it can be particularly advantageous when managing large fleets with multiple vehicles, as it simplifies budgeting and forecasting fuel spent.”

According to Mac, locking in fuel fixed-price contracts offers a level of financial control that businesses need, especially in uncertain times. “It gives administrators peace of mind that fuel costs will be predictable, regardless of market conditions. The savings and stability from this strategy can help improve profitability and contribute to a more successful, smooth-running business,” completes the executive.

Plan for the Unexpected

Fuel price volatility is a fact of life in the energy industry. With Mansfield Fuel Price Risk Management services, you can plan for the unexpected and mitigate the impact of these events on your bottom line. Protect your business against fuel price fluctuations and ensure cost stability, even in the face of unforeseen circumstances.

Our Price Risk Management experts will analyze your buying history and organizational goals to give you an analysis of your current fuel spending with a forecasted outlook and recommendations. Contact us today!

What’s Next?

In our next article, we will discuss why fixed pricing can be a smart strategy for your business, exploring how this approach can protect your bottom line and provide stability even in the face of unexpected market shifts. Stay tuned!

Our Executives

Andy Milton is the Senior Vice President of Supply and Distribution at Mansfield, with over 19 years of experience in the fuel and logistics industries. After starting his career in sports management, Andy transitioned into the energy sector, where he has held various roles, including product trading and operations management. Throughout his years at Mansfield, he has navigated significant industry challenges, such as the impact of Hurricane Katrina and fluctuating fuel markets. Andy is recognized for his strong problem-solving abilities, leadership in customer relations, and expertise in developing strategic solutions to support clients during periods of market volatility.

Mac Cullens serves as the Director of the Pricing Department at Mansfield, leveraging his extensive background in pricing strategy, market analysis, and commercial operations. Mac joined Mansfield after a successful career in banking, where he focused on commercial sales before transitioning into the fuel industry. Over his years at Mansfield, Mac has played a pivotal role in managing complex pricing strategies, including government contracts and environmental compliance programs. His deep understanding of market dynamics and pricing models has contributed to Mansfield’s continued success and its ability to adapt to shifting market conditions.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.