What Is It – Fixed Fuel Prices

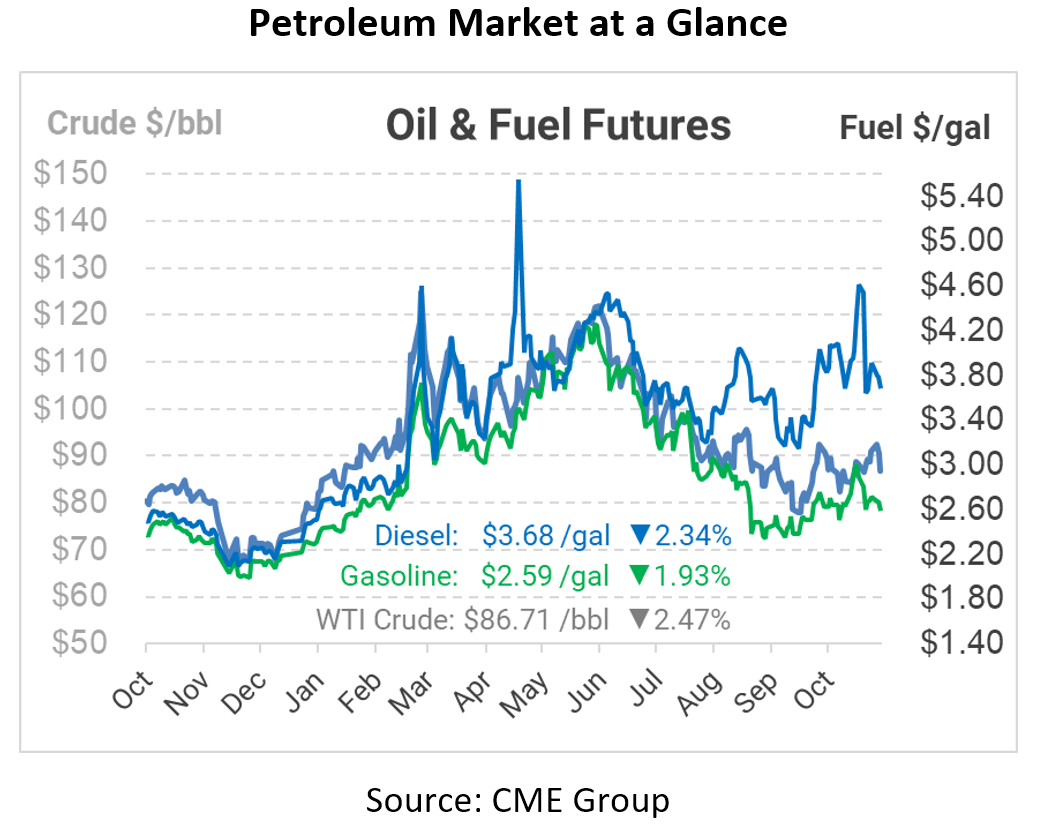

Wars, storms, cyberattacks – fuel markets have gotten pretty crazy lately. And whenever supply markets are crazy, you’re bound to see an effect on fuel prices. About six months ago, FUELSNews analyzed increasing price volatility, noting a +350% increase in daily price swings. Market disruptions have caused higher fuel prices, including historic diesel prices this year.

Diesel fuel drives the US economy – and more important for you, it probably drives your company’s budget. For most companies with fleets, diesel fuel is the #2 or #3 expense after driver labor and possibly truck costs. When fuel prices double in just a few months, it can radically impact your profitability… and maybe even your performance review. So how do you keep prices under control? How do you prevent shrinking profits and rising costs? Today, we’ll cover one method for controlling your budget – fixed fuel prices.

What is a Fixed Fuel Price?

Imagine going to a gas station and paying $2.45 for fuel, anytime, all year, no matter what the price on the pump says. That’s basically how a fixed price works.

A fixed fuel price is a way of buying fuel that keeps your fuel costs under control. You set a price, or a price range, with your fuel supplier, and you have the guarantee that your fuel will be the same price no matter what happens in the marketplace. Prices rise to $5/gal? No problem, you locked in at $3.65 a few months ago.

What Are the Different Fixed Fuel Price Options?

There are four primary types of fixed price: Simple Fixed Price, Fixed Price with an Escape, Price Caps, and Collars. By far, the most popular option is the basic fixed price – set your price and forget it. However, for customers looking for more flexibility, there are other solutions worth considering to allow prices to fall when prices drop.

When to Consider a Fixed Fuel Price?

The most important question in determining whether to lock in a fixed fuel price is knowing whether you can pass on high costs to your customers. If you’re delivering paper products, and you can raise the cost of your paper goods when fuel costs rise, then you’re covered – no need to worry about a fixed price.

A lot of businesses don’t fit this model. Construction companies often win a project contract at a set rate, and can’t charge more then fuel prices rise. Companies in a commodity business – aggregates and bulk food distributors, for example – have to charge market prices; they don’t have much wiggle room when delivering products to their customers. Government fleets can raise taxes, but that’s never a popular choice. For all these businesses, and more, it’s worth considering a fixed price.

What’s the Benefit?

The biggest benefit with a fixed price is that you can stop fretting over high prices. Forget what OPEC does, or what new wars are starting, or whether a hurricane is coming. You have guaranteed supply at a guaranteed price. In addition to this key benefit, your company benefits:

- Hit your budget predictability, without worry

- Smooth out cashflow throughout the year

- Prevent surprises that impact your profitability

- Prevent passing higher prices on to consumers

What’s the Risk?

Fixed price contracts are not 100% risk free. When you commit to a million gallons at $3.45, you’re agreeing to two things: 1) You will buy one million gallons during the timeframe set in the contract, and 2) you will pay $3.45, whether the market goes up or down.

Unpacking the first statement – you must buy all the gallons. if your volumes are not predictable, it’s important to communicate that up front. Second, your price is your price, whether prices rise or fall. It’s easy to feel like a hero when you’re paying $3.45 and the market rate is $5/gal. But prices could fall to $2.50 per gallon. Of course, there are solutions that can reduce or prevent this risk of paying over market prices.

How Do I Get a Fixed Price?

Before locking in a fixed price, you’ll want to collect some data: where do you buy fuel, how much fuel do you need, and does your company lose money when fuel prices rise? With this information in hand, you’ll be prepared to ask your fuel supplier for an indicative fixed price.

Ready to get started? Learn the steps involved in this On-Demand Fixed Price webinar.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.