Natural Gas News – November 27, 2024

Natural Gas News – November 27, 2024

Colder Winter Temps Lift Nat Gas

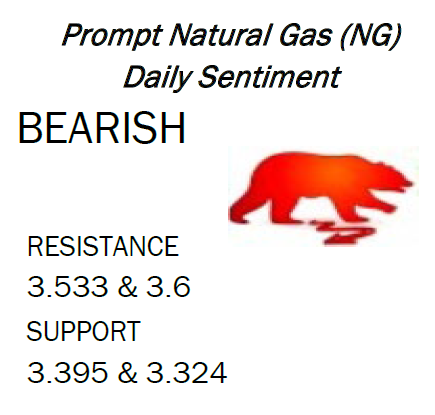

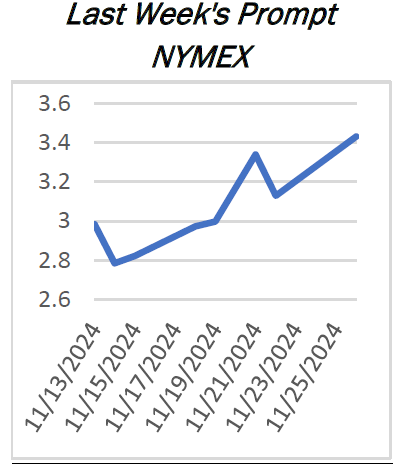

The January Natural Gas (NGF25) trading session settled at 3.467 (+0.024) [+0.70%], a high of 3.528, a low of 3.390. Cash price is at 3.355 (+0.221), while open interest for NGF25 is at 314,592. NGF25 settled above its 5 day (3.417), above its 20 day (3.148), above its 50 day (3.270), above its 100 day (3.373), below its 200 day (3.588) and below its year-to-date (3.626) moving averages. The COT report (Futures and Options Summary) as of 11/19 showed commercials with a net long position of +155,348 (a increase in long positions by +4,308 from the previous week) and non-commercials who are net short -158,349 (a increase in short positions by -2,924 from the previous week). Reuters reported that Russian gas monopoly Gazprom is planning for 2025 with the assumption that gas transit to Europe via Ukraine will cease at… https://tinyurl.com/2u6eh3x6

Guyana Eyes Gas Boom, But Can It Deliver?

In just a few short years, Guyana has become a factor to reckon with in global oil. The country is on track to hit the 1-million-bpd mark before this decade is over. It would only make sense that it would seek to capitalize on its gas reserves as well—but it’s facing challenges. Guyana has become notorious for its vast offshore oil reserves, but there is natural gas there, too. For now, this is being injected back into the wells operated by Exxon, Hess, and CNOOC, to maintain pressure. Yet the authorities in Georgetown have plans—and these plans feature LNG. Earlier this year, the government of Guyana launched a tender for companies interested in developing its gas reserves. It would have been easier to bet on the Exxon-led consortium again, but the authorities in Georgetown have made it cle… For more info go to https://tinyurl.com/2s4bzezx

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.