Natural Gas News – November 15, 2024

Natural Gas News – November 15, 2024

EIA Report Expected to Drive Volatility—Is a Bullish Rebound Ahead?

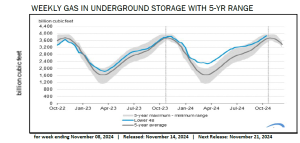

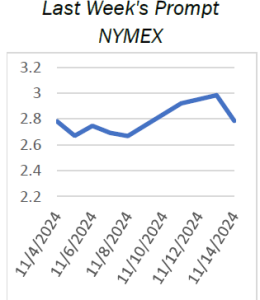

U.S. natural gas prices dip today as investors brace for a bearish EIA storage report and mixed demand forecasts. Key resistance at

$3.044-$3.051 may determine if prices rally, with technical indicators hinting at potential upside moves. Market anticipates EIA

storage build of 41-44 Bcf, surpassing the five-year average, adding bearish pressure on prices. Mild U.S. weather continues to limit

demand; colder temperatures expected later this month may support a price rally. U.S. natural gas prices are slightly lower on Thursday as investors await the latest government storage report from the U.S. Energy Information Administration (EIA). Near-term demand remains mild, though forecasts for colder weather later in the month suggest potential demand increases. In the immediate term, traders expect a bearish storage… https://tinyurl.com/37evcwuh

Can Natural Gas Rally?

Natural gas is a seasonal commodity that tends to reach highs during winter and lows during spring. The injection season, when inventories rise, runs from late March or early April through November. In November, increasing heating demand causes stockpiles to decline. Withdrawals from stockpiles run through March. Since August 2022, the continuous contract NYMEX natural gas futures prices have traded from the highest level since 2008 at $10.028 to a $1.481 per MMBtu low. As the market prepares for the 2024/2025 winter and withdrawal season in November, natural gas futures are closer to the lows at under $3 per MMBtu. After trading at a $3.406 per MMBtu high on October 4, December natural gas futures on the Intercontinental Exchange ran out of upside steam. The daily chart

highlights that… For more info go to https://tinyurl.com/2t3x5sme

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.