Natural Gas News – November 8, 2024

Natural Gas News – November 8, 2024

Bearish Sentiment to Dominate if EIA Report Meets Forecasts

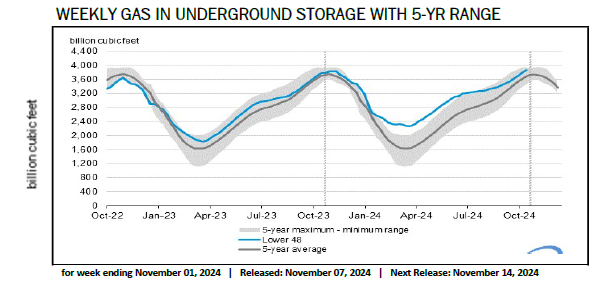

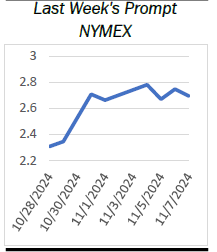

Natural gas futures dip as traders await EIA storage report, with large inventory build expected. Mild weather forecast keeps demand light, adding downward pressure on natural gas prices. EIA report likely to show 64-66 Bcf injection, well above the 5-year average of 32 Bcf. U.S. natural gas futures dipped Thursday as traders awaited the latest Energy Information Administration (EIA) storage report, due at 15:30 GMT. The report is expected to shed light on U.S. natural gas inventory levels, with an injection projected well above the seasonal average, a potentially bearish signal as the market enters a period of mild weather and steady production levels. December futures are currently trading within a narrow range, with key resistance around $2.825. A break above this level could set the stage for a rally toward… For more information, go to https://tinyurl.com/2nrs2rpj

Trump win to have policy, price impacts across commodity sectors

Former US President Donald Trump has won the 2024 race for the White House, setting into motion a host of potential impacts for the power generation, natural gas, oil, critical minerals and petrochemicals sectors. Trump campaigned on promises of deregulatory steps that aim to stamp out current President Joe Biden’s climate agenda and clear away barriers for energy production. Attempts to revise the large suite of Biden administration rules appear likely, with implications across energy commodities. Trade policy shifts could be in store for the LNG, solar, petrochemicals and other sectors, while the US oil market watches for any shift in sanctions policies. At the same time, wholesale reversals are complex undertakings, and tax credits have momentum of their own as individual projects take … For more information, go to https://tinyurl.com/4m96bzjh

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.