Natural Gas News – November 1, 2024

Natural Gas News – November 1, 2024

Price Forecast Dips as Inventory Levels Hit Seasonal Highs

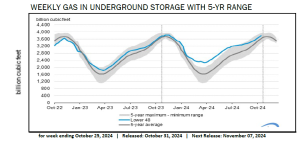

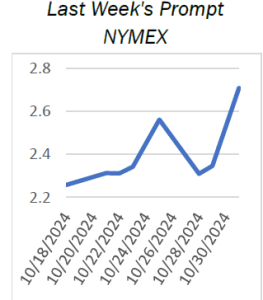

Natural gas prices dip as warmer November forecasts limit heating demand, pushing market sentiment toward a bearish outlook. U.S.

natural gas storage climbs 78 Bcf this week, hitting 3,863 Bcf—107 Bcf above last year and exceeding the five-year average. Technical

analysis shows natural gas support at $2.585, with resistance at $2.764, hinting at further potential price declines. U.S. natural gas

futures declined Friday, driven by forecasts of warmer-than-normal November weather, high storage levels, and steady production rates.

Prices have slipped below October’s low, signaling a bearish tone as traders anticipate limited heating demand through mid-November.

Despite steady liquefied natural gas (LNG) demand, ample supplies and reduced demand for heating are weighing heavily on the market. At 14:54 GMT, Natural Gas… https://tinyurl.com/4yr8uy27

Germany Posts Second Consecutive Year Drop in Gas Consumption

Germany posted a second consecutive year-on-year decline in gas consumption for the week ended Oct. 27, with usage remaining well

below pre-crisis levels, data from the country’s energy regulator showed Nov. 1. According to Bundesnetzagentur data, total consumption averaged 2.09 TWh/d, down 8% from the same week in 2023 and 20% lower than the pre-crisis average for the week from

2018 to 2021. It followed a 7% year-on-year drop in consumption in the week to Oct. 20 after six weeks of consecutive year-on-year

increases. Gas consumption in Germany has stayed significantly below pre-crisis levels from 2022 to 2024, with demand spiking only

during unseasonably cold weather, most recently in January and April. It hit multiyear lows earlier in the summer. Industrial gas

consumption — including t… For more info go to https://tinyurl.com/2bdh3mj7

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.