Natural Gas News – October 22, 2024

Natural Gas News – October 22, 2024

Will Slowing China Growth Push Prices Lower?

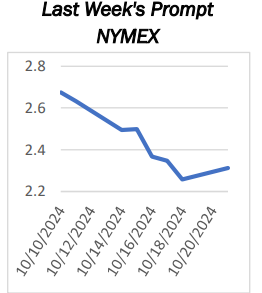

Natural Gas and Oil prices face bearish pressure as geopolitical tensions and weak Chinese demand continue to weigh heavily. The pivot point for natural gas sits at $2.37, and a break below could signal further downside, with key support at $2.29. Oil prices fluctuate amid geopolitical risks; resistance at $71.10 could trigger a bullish reversal if breached. Oil prices have fluctuated in response to ongoing geopolitical tensions and slowing demand growth in China, the world’s largest oil importer. Brent and WTI crude recouped nearly 2% on Monday, following last week’s 7% drop, driven by market nervousness over potential supply disruptions. While technical profit-taking supported gains, forecasts suggest an oversupplied market and weaker demand. China’s recent rate cuts aim to stimulate its

slowing economy, but… For more info go to https://tinyurl.com/jkpmezsh

Will Weakness Push Gas Futures Below Critical $2.201 Support?

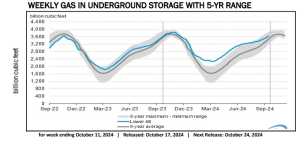

Mild weather continues to cap natural gas demand, keeping futures under bearish pressure despite occasional rallies. EIA reports a 76 Bcf storage injection, pushing working gas levels 163 Bcf above the five-year average, capping upside potential. Bearish outlook ahead: Natural gas futures may test support at $2.201 with risks of further drops toward $1.882 in the near term. Resistance at $2.510 and the 50-day moving average remain key technical levels as natural gas prices face further declines. U.S. natural gas prices faced a difficult week, extending their downtrend as mild weather forecasts continued to cap demand. Futures closed Friday on a bearish note, pressured by weak fundamentals and technical breakdowns. Despite occasional rallies, the market sentiment remained heavily tilted tow…For more info go to https://tinyurl.com/4mpmmfy4

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.