Natural Gas News – October 17, 2024

Natural Gas News – October 17, 2024

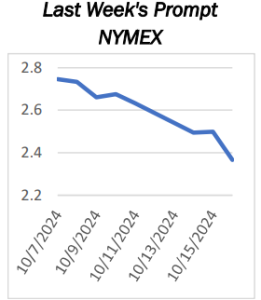

Futures Slip as 7-15 Day Weather Forecast Eases Demand

Natural gas prices drop sharply as traders react to mild weather forecasts and key support levels are violated. Bearish technical signals: Prices fall below key retracement zone, with $2.201 as the critical support level to watch. Mild US weather forecast weakens demand, pressuring natural gas futures and driving bearish market sentiment. Eyes on Thursday’s EIA report—traders anticipate potential bearish signals amid declining demand and rising inventory.

US natural gas prices tumbled on Wednesday, reacting to a weak weather outlook for the upcoming 7-15 day period. Prices failed to surpass resistance at the 50-day moving average, leading to a significant decline. Currently, traders are focusing on two key price levels—minor bottoms at $2.403 and $2.305—which are the final barriers before a potential drop to the m… For more info go to https://tinyurl.com/4pydpe2t

Europe’s Natural Gas Demand Drops While Inventories Rise

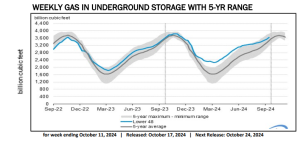

Global natural gas demand decreased slightly in August, while European inventories rose. European industrial gas consumption has increased but is expected to fall again due to high energy costs and weak economic conditions. European industry faces challenges in competing globally due to high energy costs compared to other regions. Natural gas demand in the EU and the UK fell by 0.7 bcm in August from July while inventories increased by 8.7 bcm, the Joint Organizations Data Initiative (JODI) said in its monthly oil and gas review on Thursday. Global natural gas demand also fell lightly, by 0.15 bcm month-on-month in August, according to the latest data in

JODI, which compiles self-reported figures from individual countries. On a yearly basis, global natural gas demand rose by 2.3 bcm compar… For more info go to https://tinyurl.com/ybz7xzjc

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.