Natural Gas News – October 15, 2024

Natural Gas News – October 15, 2024

Natural Gas Continues to See Selling

The natural gas market pulled back a bit in the early trading on Monday, as the market continued to look at the hurricane as a driver previously, but now will start to focus on the upcoming winter in the United States. The natural gas markets have drifted a little bit lower during the trading session on Monday in the early hours as market

participants continue to see a lot of noisy behavior. That being said, I think it’s probably only a matter of time before we have to ask questions of $2.80 underneath, which is an area that previously has been supported. If we break down below there, we could at least in theory be looking at a bit of a “head and shoulders pattern”, which of

course has people standing up and paying attention. And for what it is worth, it could kick off an 11% drop, which would have this market… For more info go to https://tinyurl.com/2mhrxx6c

Nat-Gas Prices Tumble as US Weather Forecasts Warm

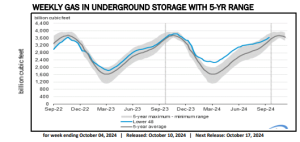

November Nymex natural gas (NGX24) on Monday closed down by -0.138 (-5.24%). Nov nat-gas prices Monday tumbled to a 3-week nearest-futures low and closed sharply lower. Forecasts for warmer US temperatures that will reduce heating demand for nat-gas are weighing on prices. Forecaster Maxar Technologies said Monday that forecasts shifted warmer for the Midwest and eastern part of the US for October 19-23. Also, fuel demand concerns are undercutting nat gas prices. As of Monday afternoon, about 400,000 people in Florida were still without power due to outages caused by Hurricane Milton, reducing nat-gas demand from electricity providers. Lower-48 state dry gas production Monday was 101.6 bcf/day (-2.0% y/y), according to BNEF. … For more info go to https://tinyurl.com/mptwc2y7

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.