Natural Gas News – October 3, 2024

Natural Gas News – October 3, 2024

Market Awaits Report as Inventory Forecast Boosts Bullish Outlook

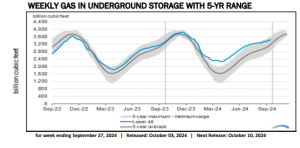

Natural gas futures climb as traders anticipate smaller-than-average storage injection in EIA report . EIA report expected to show +56 Bcf build, well below five-year average of +98 Bcf. Technical resistance near $2.939 and $2.968 may cap gains. Psychological $3.00 barrier tested; breakthrough could accelerate buying towards $3.110

Fibonacci level U.S. natural gas futures are climbing as traders anticipate the Energy Information Administration’s (EIA) Weekly Storage report. This report, scheduled for release today, is expected to show a smaller-than-average injection into storage, providing a bullish catalyst for the market. However, traders are facing resistance levels that could cap gains and bring potential downside risk. At 13:16 GMT, Natural Gas futures are trading $2.952, up $0.066 or +2.29%. Natural gas… For more info go to

https://tinyurl.com/3xk55k9c

Production, Consumption Show China Gaining Ground in Its Gas Goals

China’s latest Natural Gas Development Report shows the nation made gains last year in efforts to restructure its natural gas market, increasing domestic production and consumption; boosting imports of liquefied natural gas; adopting technologies to boost domestic exploration and production and cut emissions; and reforming pipeline

transmission tariffs.[1] The new tariffs are likely to help grow natural gas supplies, reduce end-user costs and increase consumption. The world’s top importer of natural gas now supplies about 60 percent of its demand with domestic supplies, thanks in part to reforms aimed at increasing domestic supplies and consumption. As the world takes on many challenges from climate change and energy transition, China’s use and views of natural gas in its energy mix are… For more info go to https://tinyurl.com/2j8u3mvm

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.