Natural Gas News – September 24, 2024

Natural Gas News – September 24, 2024

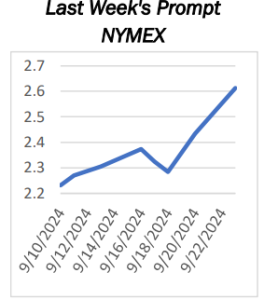

Traders Eye Gulf Storm and Key Resistance Levels in Today’s Market

Natural gas futures rise for the fourth session as traders speculate on the impact of a looming Gulf hurricane. The storm is expected to miss Louisiana’s production zones, but bullish sentiment continues to drive prices higher. NatGasWeather predicts low demand due to mild temperatures, limiting price gains despite strong LNG demand.

Key technical resistance levels at $2.757 and $2.797 could trigger selling pressure unless the storm hits production. U.S. natural gas futures advanced for the fourth straight session on Tuesday, as traders speculated on the potential disruption to gas production due to a developing storm in the Gulf of Mexico. Though the hurricane is expected to strengthen and move northward toward Florida, it is projected to avoid key oil and gas production zones in Louisiana, reducing the likelihood… For more info go to https://tinyurl.com/4mtjfd4d

Trouble Deepens for North Sea Oil and Gas

North Sea oil and gas operators are not just facing the prospect of higher windfall taxes, they are now also finding it more difficult to get loans from UK banks. The windfall profit tax was imposed on the energy industry in 2022 amid record profits resulting from the supply uncertainty in oil and gas following the incursion of Russian troops into Ukraine. According to data from Norwegian investment bank SpareBank 1 Markets, reserve-based lending to oil and gas operators in the UK’s North Sea had fallen by some 40-50% since the introduction of the windfall profit tax. When the Labour Party came into power, it vowed to tax the oil and gas industry more. Warnings this might backfire fell on deaf years. Now, banks are refusing to lend to North Sea operators. It may well end with energ… For more info go to https://tinyurl.com/rc4v964t

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.