Oil Sits Below $70 While Francine Looms Over US Supply

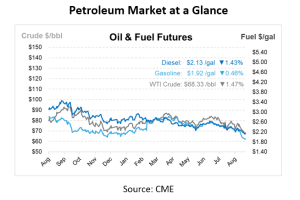

Oil prices fell on Tuesday, reversing yesterday’s gains, as concerns over weakening global demand overshadowed U.S. supply disruptions caused by Tropical Storm Francine. Despite both benchmarks rising around 1% on Monday, ongoing risks of global oil oversupply weighed on the market. This morning, crude opened at $68.78, diesel at $2.15, and gasoline at $1.93. Crude is sitting 20 dollars below where it was this time last year, while diesel and gasoline are roughly $1 below their September 2023 price.

OPEC reduced its global oil demand growth forecast for 2024 to 2.03 Mbpd and for 2025 to 1.74 Mbpd. Economic data from China showed fragile domestic demand, further pressuring prices. Forecasts for oil demand growth in 2024 show an unusually wide range of predictions, primarily due to differing views on China’s economic outlook and the speed of the global transition to cleaner energy sources. Despite a reduction in its forecast, OPEC’s estimate remains on the higher end of industry projections.

Some market participants are predicting that oil prices may range between $60 and $70 per barrel due to weak demand from China and ongoing global oversupply. Despite oil prices briefly rising earlier this year, they have faced downward pressure from reduced demand in key economies. OPEC+ recently delayed a planned output increase, but traders warn that oversupply will persist. The International Energy Agency (IEA) expects global oil supply to reach record levels this year, driven by production growth in the U.S., Canada, Guyana, and Brazil, which may continue to weigh on prices. Concerns also remain over China’s soft demand and potential economic stimulus.

Tropical Storm Francine led to the closure of several Texas ports and disrupted offshore production. Francine, which is expected to become a hurricane today and make landfall in Louisiana on Wednesday, has led several Gulf of Mexico producers to evacuate workers, cease drilling, and shut in wells, affecting around 125,000 bpd of crude production. The storm could potentially impact up to 5.8 million bpd of refining capacity along the U.S. Gulf Coast.

With contracts granted for more than 1.1 million barrels each month in the first quarter of 2025, the U.S. Department of Energy has acquired more than 3.4 million barrels of petroleum for the Strategic Petroleum Reserve. At an average cost of about $76 per barrel, the DOE has now purchased almost 50 million barrels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.