Natural Gas News – August 27, 2024

Natural Gas News – August 27, 2024

Will Supply Concerns Counteract China’s Demand Slowdown?

Oil prices retreat after a 7% surge, driven by Middle East tensions and potential Libyan supply disruptions. Bearish global demand, especially from China, could pressure oil prices despite looming supply risks from Libya. Natural gas holds near $1.957; a drop below $2.01 could signal bearish momentum with support at $1.90 and $1.83. After a 7% surge over the last three sessions, oil prices have retreated, reflecting market concerns about potential supply disruptions. The spike was driven by escalating geopolitical tensions in the Middle East and the possibility of a Libyan oil field shutdown. These developments heightened fears of a broader conflict that could impact the region’s oil supply. Although bearish sentiment around global oil demand, especially from China, could pressure prices, the looming supply… For more info go to

https://tinyurl.com/4dyfe9ju

Natural Gas Retreats Toward $2 on EIA Report & Mild Weather

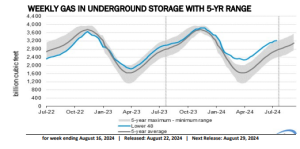

The U.S. Energy Department’s weekly inventory release showed that natural gas supplies increased more than expected. The bearish inventory numbers, together with supply and weather headwinds, affected natural gas futures, which settled with a loss week over week. As a matter of fact, the commodity is currently trading around

the lowly $2 level. Considering that the space remains highly susceptible to unpredictable temperature patterns that impact prices and market stability, at this time, we advise investors to focus on stocks like Coterra Energy CTRA and Cheniere Energy LNG. Stockpiles held in underground storage in the lower 48 states rose 35 billion cubic feet (Bcf) for the week ended Aug 16, above the analyst guidance of a 28 Bcf addition. The increase compared with the five-year (2019… For more info go to https://tinyurl.com/mswxcnvs

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.