Natural Gas News – August 20, 2024

Natural Gas News – August 20, 2024

Bulls Defend $2.091 Support, Awaiting Bullish Weather Boost

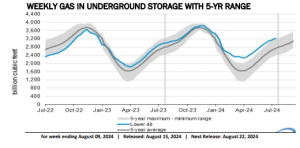

Natural gas futures rise as bulls target $2.315, supported by bullish sentiment after testing $2.091. Last week’s price swings driven by weather forecasts and profit-taking; market weighs short-term demand dips. Sizzling heat in the western U.S. could spike cooling demand, but cooler Northeast weather tempers expectations. EIA reports rare August storage withdrawal; cooling demand and lower gas production tighten supply-demand balance. Geopolitical tensions and reduced investment slow new gas projects, complicating global supply chains and market dynamics. U.S. natural gas futures are gaining ground as the market begins a new trading week. Prices are moving up after testing the minor pivot at $2.091, with bullish traders targeting the main top at $2.315. At 13:29 GMT, Natural Gas Futures are trading $2.184, up $0.… For more info go to https://tinyurl.com/uytekuhc

Lower Natural Gas Prices Weighing On Production: UBS

Investing.com — US natural gas prices slipped below $2/mmbtu in early August before recovering slightly to around $2.1/mmbtu. This follows a broader downward trend in energy prices. Analysts at UBS Research in a note dated Monday said that this price decrease has affected natural gas production in the lower 48 states, which has

declined after reaching a peak in July. “The main driver of the recent price decay was ongoing storage congestion risks, in our view,” analysts at UBS said in a note. Throughout July, US natural gas production surged, exceeding 103 billion cubic feet per day (bcf/d) as prices rebounded during the second quarter. However, as

production soared, so did the risk of overwhelming storage capacities, which in turn applied downward pressure on prices. UBS analysts flag… For more info go to https://tinyurl.com/2hn6djr8

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.