Natural Gas News – August 15, 2024

Natural Gas News – August 15, 2024

Prices Edge Higher as Traders Eye Bullish EIA Report

Natural gas futures rise as traders await a crucial EIA storage report, eyeing a potential bullish market shift. EIA storage estimates range from 0 to 9 Bcf, with some predicting a rare midsummer draw that could tighten balances. Market sentiment turns bullish as money managers increase net long positions, anticipating stronger cooling demand. Key technical level at $2.315 could trigger an acceleration toward $2.461 if the bullish outlook continues. High-pressure systems boost natural gas demand across major U.S. regions, driving the market’s bullish momentum. U.S. natural gas futures are gaining momentum as traders anticipate the Energy Information

Administration’s (EIA) weekly storage report, which is set to be released today at 14:30 GMT. Market expectations of increased demand are providing additional support… For more info go to https://tinyurl.com/3jhuvvdw

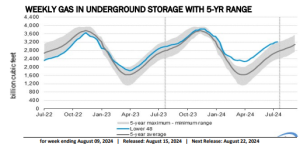

Gas Prices Push Higher for Hotter Temps and Smaller Inventories

Sep Nymex natural gas (NGU24) on Wednesday closed up by +0.071 (+3.31%). Sep nat-gas prices on Wednesday rallied to a 3-week high on forecasts for hotter US weather that would boost nat-gas demand from electricity providers to run air conditioning. Forecaster Maxar Technologies said Wednesday that forecasts have shifted hotter in the eastern and southwestern parts of the US for August 24-28. Also boosting nat-gas prices on Wednesday is the outlook for Thursday’s weekly EIA nat-gas inventories to climb well below seasonal averages, which could shrink current elevated US inventories. The consensus is that Thursday’s’ weekly EIA nat-gas inventories will climb by +1 bcf, well below the five-year average for this time of year of +43 bcf. Last Monday, nat-gas prices tumbled to a 3-1/2 month… For more info go to https://tinyurl.com/5bmh3p6c

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.